The Barclays share price has been in a strong bearish trend in the past few days as concerns about the banking sector remain. The stock is trading at 152p, which is the lowest since February 2021. It has fallen by almost 30% from its highest level this year. The same is true for Barclays ADRs in the US, trading at $8.50.

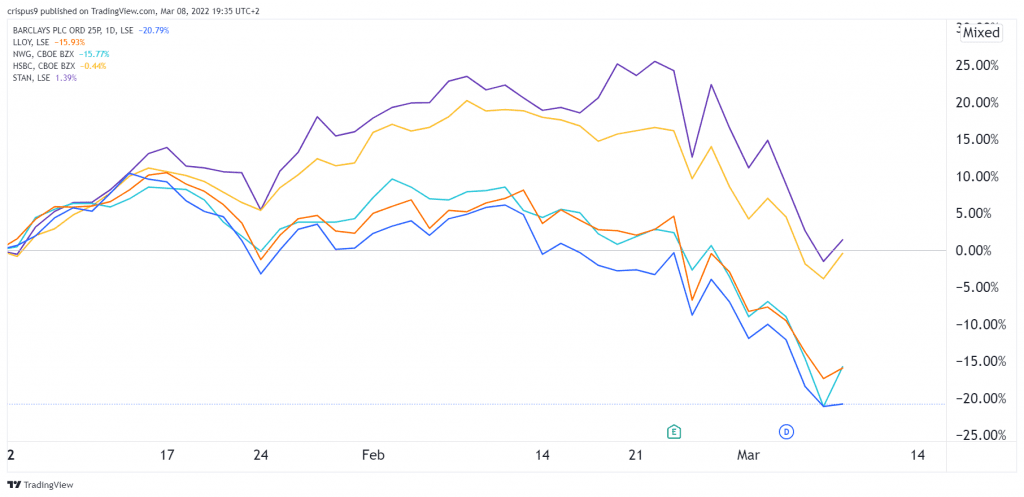

As shown below, Barclays shares have underperformed other banks like HSBC, NatWest, Lloyds, and Standard Chartered.

What is Barclays Bank?

As shown below, Barclays shares have underperformed other banks like HSBC, NatWest, Lloyds, and Standard Chartered.

Barclays is one of the biggest banks in Europe. The firm has a market cap of over 25 billion pounds and 85,000 employees globally. It makes money in several ways. For example, the bank offers several services like personal banking, Barclaycard, and business banking in the UK. In 2021, this division had combined revenue of over 6.6 billion pounds.

Barclays also makes money in its international markets, offering its solutions in many countries. In 2021, its international markets revenue was about 3.3 billion pounds. Finally, unlike other banks like Lloyds and Natwest, Barclays has a large corporate and investment bank that makes over 13 billion pounds. Its activities in this division are global markets (FICC), investment banking, and corporate banking.

Barclays has had a long and storied history. For example, it exited the African market a few years ago. It also made a mistake by selling its iShares unit to Blackrock in a $13.5 billion deal. At the time, the division had about $300 billion in assets. Today, it has helped Blackrock become the biggest money manager globally with over $10 trillion in assets.

Why the BARC share price has fallen

There are several reasons why Barclays’ share price has dropped sharply in the past few weeks. Other banks have also crashed, with the SPDR Bank ETF (KBE) falling by over 6% since the year started.

First, there are concerns that the world economy is moving to a recession because of the ongoing Russian invasion of Ukraine. Rising energy prices will likely cause this recession. For example, oil has jumped to over $132 per barrel, a remarkable figure since the prices were below $15 in 2020.

Therefore, since consumer spending is the most important part of the economy, it is likely to be affected. This will then affect the bank’s business operations in its key markets.

Second, the rising fears of a recession will also impact key central banks like the Bank of England (BOE) and the Federal Reserve. The banks could find it difficult to hike interest rates in a recession period. Furthermore, it will be the first time in years that the Fed is hiking rates in a period of a flat yield curve. Still, the banks believe that rate hikes are helpful in a period of surging inflation.

Third, the Barclays share price has retreated because of the rising risks of major cybersecurity attacks in the banking sector. Now that most western countries have sanctioned Russia, the country could react by attacking the financial sector, which is an important industry.

Finally, there is a likelihood that deal-making will slow down this year after the spectacular performance in 2021. Besides, many regulators have added more barriers to takeovers. For example, Nvidia was forced to cancel its takeover bid of Arm Holdings.

Is Barclays a good investment?

Many analysts believe that Barclays is a better investment than other UK banks like Lloyds and Natwest. The main reason is that the company is highly diversified than other banks. If the lending business disappoints, the performance is usually offset by the other segments.

We saw this work perfectly during the Covid-19 pandemic. In 2020, the company announced huge losses, thanks to provisions for bad loans. However, these losses were offset by the strong performance of its trading business.

Indeed, it will not be a surprise if the company’s trading business delivers strong results in the first quarter despite the weakness experienced in the stock market. In addition, the company’s investment banking also did well because of the strength of dealmaking.

Still, like all UK banks, Barclays has connections to the red-hot housing market. Data published last week showed that the house prices jumped sharply in February. This view was confirmed by Halifax, which confirmed that the sector was still strong. Still, the concern is what will happen if the sector starts slowing down.

Barclays stock analysts forecasts

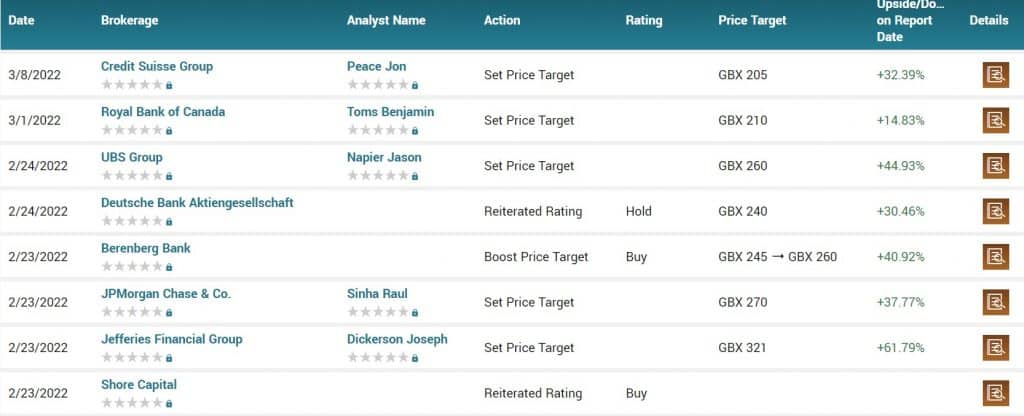

Analysts are bullish about Barclays share price. For example, those at Credit Suisse believe that the stock could rise to about 205p. Similarly, those at Royal Bank of Canad, UBS, and Deutsche Bank see the shares rising above 210p. According to Marketbeat, the average target for the stock among analysts is 262p, which is substantially higher than the current level.

Does Barclays pay dividends?

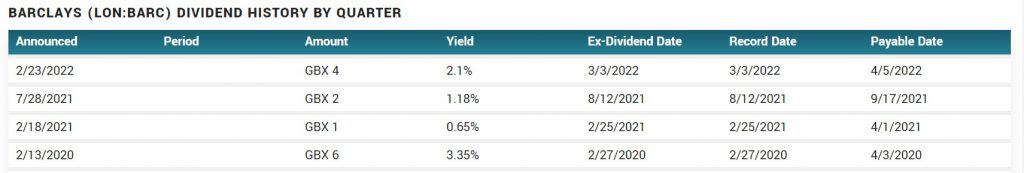

Like all UK banks, Barclays was forced to halt paying dividends during the Covid-19 pandemic. The Bank of England implemented the policy in a bid to help banks save money because it was extremely difficult to predict the future.

Barclays started paying dividends in 2021 as its profits jumped. It initially paid a GBX 1 dividend and then doubled it to 2 GBX. In its most recent quarter, the company decided to pay a dividend of GBX, giving it a dividend yield of 2.1%

Barclays share price forecast

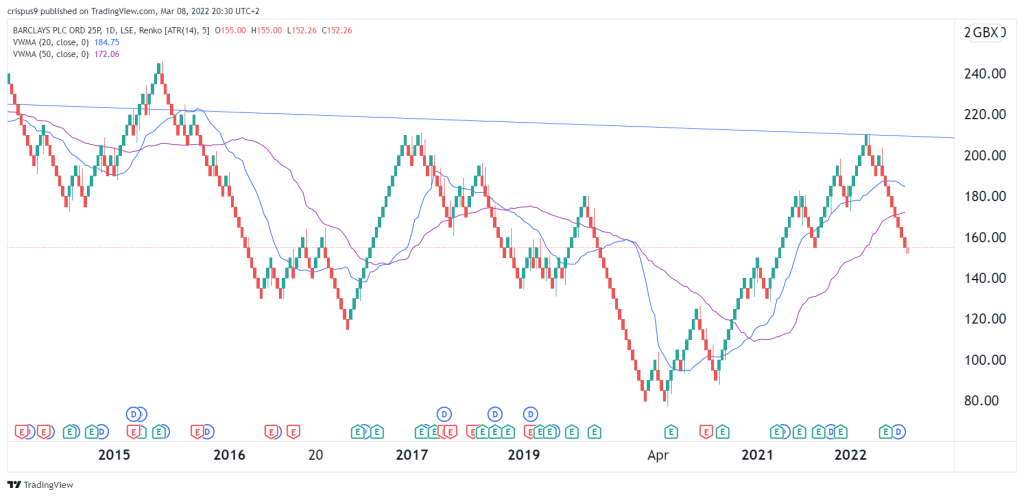

The Renko chart below shows that the BARC share price has been in a strong bearish trend. It remains below the key resistance level that is shown in blue. At the same time, it has moved below the 20-day and 50-day volume-weighted moving average (VWMA).

Therefore, for now, there is a likelihood that the shares will continue falling as bears target the next key support at 145p. On the flip side, a move above the key resistance at170p will invalidate the bearish view.