- What’s the outlook of the Aviva share price? We explain why the AV stock price has done well and what comes ahead.

Aviva share price has done relatively well as investors focus on the company’s transformation and the new normal of high-interest rates. The AV stock is trading at 422p, a few points below its year-to-date high of 445p. Nevertheless, it has risen by about 25% from its lowest level in March this year, bringing its market value to 15.6 billion pounds.

Aviva is a large financial services company that has been on a transformation journey. In the past few years, the firm’s management has managed to sell non-core businesses. It sold eight of its businesses and generated about 7.5 billion pounds. The resulting firm focuses only on retirement, protection, and P&F.

These are businesses that are highly predictable, which explains why it has outperformed Legal & General and Phoenix. UK Life is its main business, generating about 70% of its total income. As such, Aviva is a slow-growth company with highly-predictable returns. However, it also has a few outstanding issues.

At the same time, Aviva is one of the best dividend payers in the FTSE 100. The firm returned 4.75 billion pounds to shareholders through a combination of dividends and buybacks, and it expects that the process will continue going forward. As a result, it has a trailing 12-month dividend yield of 5.24% and a 13.6% forward yield.

Another thing that will benefit Aviva share price is the hawkish Bank of England (BOE). The bank has already started hiking interest rates, and analysts believe it will deliver at least 2 to 3 more hikes this year. On the other hand, the Fed intends to hike rates at least six more times. Therefore, with over 334 billion pounds of assets under management (AUM), Aviva will likely deploy some funds to interest-bearing investments.

Aviva share price forecast

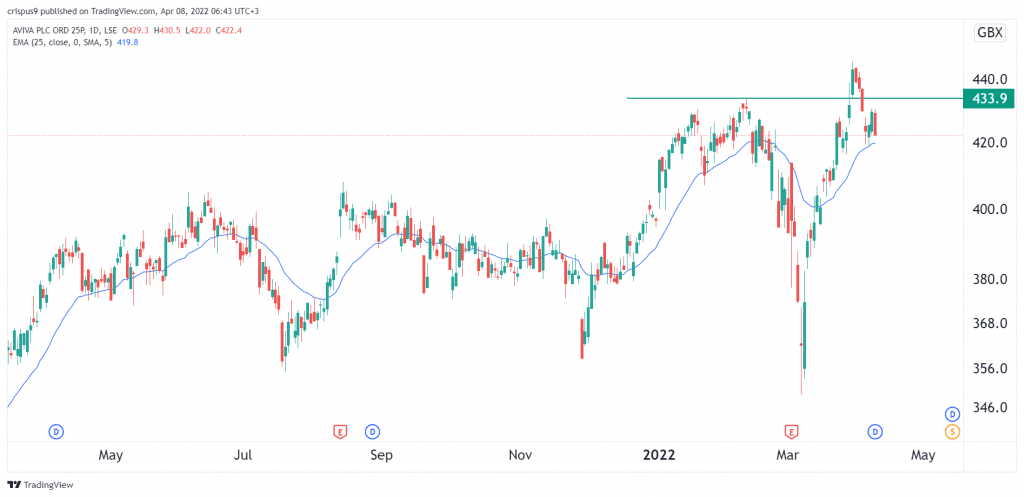

My last forecast of Aviva was accurate. Aviva had a spectacular March as investors bought the dip. At the time, the company’s stock moved from a low of 348p to 445p. The stock managed to move above the important resistance level at 433p, which was the previous YTD high.

Now, the shares have made a pullback and dropped below that support. However, it is still being supported by the 25-day moving average. Therefore, there is a likelihood that the AV stock price will resume the bullish trend in the coming months. If this happens, the next reference level will be the YTD high of almost 450p.