- What is the outlook of the Vodafone share price even as it has a mountain of debt? We explain whether it is a good buy.

Vodafone share price is having a mixed year in 2022. The VOD stock has risen by about 12% this year, but it has also dropped by 10% from its highest point, YTD. However, it has recovered by 9.2% from its YTD low and then moved sideways in the past few days. As a result, the stock has performed better than the FTSE 100 index and BT.

Vodafone is a giant telecommunication company that has operations around the world. The firm’s most important markets are in Europe, where it offers its services in key markets like the UK and Germany. The company has generated revenue of over $51 billion in the trailing twelve months. At the same time, its higher costs and crisis have seen it lose about $151 million in this period. It had an EBITDA of over $13.6 billion.

A quick look at Vodafone’s business shows a highly indebted company. With rates rising, the company will need to pay more money to its creditors. Its balance sheet shows that it had €60.6 billion in total debt in September last year. This was a strong figure since it had a debt of €64 billion in the same period a year before. Vodafone also had total cash of €13.6 billion. Therefore, its net debt is about €47 billion.

Ideally, higher debt is not always risky, especially for a company with stable cash flows like Vodafone. The company has the means to generate cash to cover this debt when the need arises. For example, it seeks to sell its Indian tower business in a deal that could generate about $2.5 billion. Some activists are even pushing for a more severe process of breaking the company apart.

Therefore, while I am concerned about Vodafone’s covered ratio of 1.86, it is likely to keep paying its debt. So, what’s next for the VOD share price?

Vodafone share price forecast

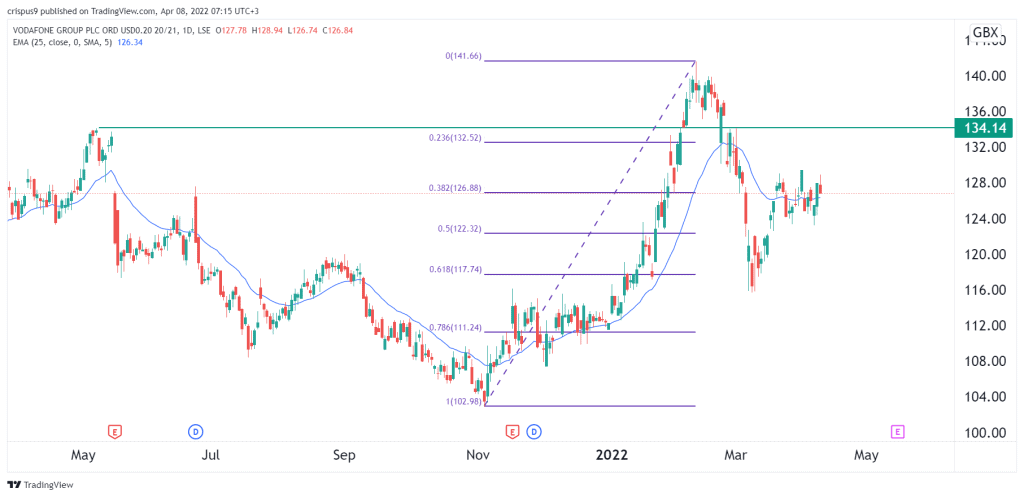

The daily chart shows that the VOD stock price started a strong recovery rally in November last year. At the time, the stock was trading at 102p, and it managed to rise to a high of 141p. It then erased some of these gains when Russia invaded Ukraine. The stock is now trading at $126, along with the 38.2% Fibonacci retracement level.

Therefore, the outlook is neutral, with the stock being in a consolidation mode. A bullish breakout will be confirmed if the stock moves above 130p. If this happens, the next key level to watch will be at 134p, which was the highest point in May 2021.