- USDJPY might be about to embark on a strong bullish trend on the heels of increased risk appetite. Read more to find out what levels traders are watching.

The USDJPY might be about to embark on a strong bullish trend on the heels of increased risk appetite. Earlier today, the S&P 500 and Nasdaq 100 reached new all-time highs, and President Trump was quick to reach for Twitter to announce the latest developments. He said:JTNDYmxvY2txdW90ZSUyMGNsYXNzJTNEJTIydHdpdHRlci10d2VldCUyMiUzRSUzQ3AlMjBsYW5nJTNEJTIyZW4lMjIlMjBkaXIlM0QlMjJsdHIlMjIlM0VUaGUlMjBTJTI2YW1wJTNCUCUyMGp1c3QlMjBoaXQlMjBhbiUyMEFMTCUyMFRJTUUlMjBISUdILiUyMFRoaXMlMjBpcyUyMGElMjBiaWclMjB3aW4lMjBmb3IlMjBqb2JzJTJDJTIwNDAxLUslRTIlODAlOTlzJTJDJTIwYW5kJTJDJTIwZnJhbmtseSUyQyUyMEVWRVJZT05FJTIxJTIwT3VyJTIwQ291bnRyeSUyMGlzJTIwZG9pbmclMjBncmVhdC4lMjBFdmVuJTIwa2lsbGVkJTIwbG9uZyUyMHNvdWdodCUyMElTSVMlMjBtdXJkZXJlciUyQyUyMEFsLUJhZ2hkYWRpLiUyMFdlJTIwYXJlJTIwc3Ryb25nZXIlMjB0aGFuJTIwZXZlciUyMGJlZm9yZSUyQyUyMHdpdGglMjBHUkVBVCUyMHVwd2FyZCUyMHBvdGVudGlhbC4lMjBFbmpveSUyMSUzQyUyRnAlM0UlMjZtZGFzaCUzQiUyMERvbmFsZCUyMEouJTIwVHJ1bXAlMjAlMjglNDByZWFsRG9uYWxkVHJ1bXAlMjklMjAlM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGdHdpdHRlci5jb20lMkZyZWFsRG9uYWxkVHJ1bXAlMkZzdGF0dXMlMkYxMTg4ODEzMDU1MTA4Mzc0NTMzJTNGcmVmX3NyYyUzRHR3c3JjJTI1NUV0ZnclMjIlM0VPY3RvYmVyJTIwMjglMkMlMjAyMDE5JTNDJTJGYSUzRSUzQyUyRmJsb2NrcXVvdGUlM0UlMjAlM0NzY3JpcHQlMjBhc3luYyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGcGxhdGZvcm0udHdpdHRlci5jb20lMkZ3aWRnZXRzLmpzJTIyJTIwY2hhcnNldCUzRCUyMnV0Zi04JTIyJTNFJTNDJTJGc2NyaXB0JTNFAs for the S&P 500, CNBC reported earlier today that out of the 200 firms of the S&P 500 companies that have reported earnings so far only 32 of them have mentioned recession on their calls, which is 16% of all firms that have reported earnings.

The mood is also undoubtedly better on the slashing of rates by the Federal Reserve and ECB, with the latter also introducing QE in the last few months.

Technical Outlook

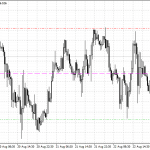

As for the USDJPY, the pair has mirrored some of the gains in the US stock markets, but a significant inverse head and shoulder pattern that has been developing since June suggests that more might lie ahead.

The July low and October lows make the left and right shoulders, while the August low is the head of the pattern. A neckline goes via the July 10, September 18, and October 1 highs. The pattern triggered a buy signal already on October 15, however, the price has been trading sideways since then. Yet as stock markets have gained in the last few days, and the USDJPY is now nearing the July 8 high, we might see a breakout.

The most significant near term risk to the bullish mood is Friday’s NFP and ISM report. Both reports are anticipated to show that the economy is struggling. Also, earlier today, the Chicago Fed Index and Dallas Fed index failed to meet expectations, the latter printer -5.1 but is still above -12.1 in June, while the former slid to -0.5 and matched the lows in May 2019.