- USDJPY is trading higher despite positive data from Japan. The question is, can the currency pair sustain its gains with the FOMC Meeting Minutes on tap?

Despite positive data from Japan, the yen weakened and USDJPY is now trading 0.08% above its opening price at 107.81. Earlier today, Japan’s core machinery orders for March came in at -0.4% which was better than the -6.8% forecast. With the FOMC meeting minutes due later today, can the currency pair extend its gains?

If there is no mention of negative rates, it just may. Federal Reserve Chairman Jerome Powell has said in a speech last week that the central bank will not impose them anytime soon. If his sentiment is reflected in the meeting minutes, USDJPY may rally.

On the other hand, if policymakers are considering negative rates, USDJPY may fall. It would be dovish news for the dollar and would not align with earlier remarks from Powell. It may just take the market by surprise.

Download our Q2 Market Global Market Outlook

USDJPY Outlook

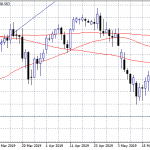

On the 4-hour time frame, it can be seen that USDJPY has made higher lows after a series of lower lows. With this, an inverse head and shoulders pattern has formed. When enrolling to our free forex trading course, you will learn that this is considered as a bullish reversal pattern. This mean that if there are enough buyers to push USDJPY above the neckline resistance at 108.00, we could see a bigger bullish rally. The currency pair could then head to 109.37 where it topped on April 6.

On the other hand, if sellers are able to push USDJPY below the low of May 13 at 106.73, the inverse head and shoulders will have been invalidated. Instead of a bullish run, we could see USDJPY drop to 105.96 where it bottomed on May 6.