- Jerome Powell, Head of the FOMC is now giving comments after the Federal Funds Rate cut and may have hinted at pausing rate cuts in the near-term.

Jerome Powell, Head of the Federal Open Market Committe (FOMC) is providing comments on what guided the decision to lower the Federal Funds Rate by 25 basis points to the 1.5% – 1.75% band.

Key quotes are expressed below, as taken from Reuters news agency.

- “Today’s cut in interest rates was insurance against ongoing risks.”

- “The performance of the US economy, particularly the household sector, has been strong.”

- “Weakness in global growth and trade pose ongoing risks.”

- “Risks to economic outlook seem to have moved in a positive direction.

- “The current stance of monetary policy is likely to remain appropriate.”

- “It would take a material reassessment in the outlook for the Fed to change its policy stance.”

- “The Fed’s policy adjustments made today will continue to provide significant support to the economy.”

- “Fed believes monetary policy is in a good place.”

In further comments, Powell also said that the “Fed continues to expect the economy to expand at a moderate rate.”

“Inflation seems to be settling in below 2%…the Fed is not thinking about raising interest rates right now, he further stated.”

“The current stance of monetary policy will be appropriate as long as the outlook is in keeping with the Fed’s expectations.”

Some of the statements (bolded) seem to infer that the Fed may be done with rate cuts in the near-term, as is also explained in this article.

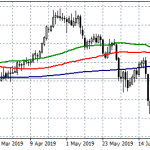

The USDCHF is currently trading in a very choppy trading session at 0.9909, after tasting session highs at 0.9940.

The push to parity continues to remain elusive for this pair, with price now challenging the support cluster at 0.9906 (Oct 25 low).

A break below current levels could target 0.9894 (S3 pivot and previous low of October 24) and possibly 0.9874 if downward pressure is big enough.

A price recovery that pushes USDCHF beyond 0.9945 could target last week’s highs at 0.9958.