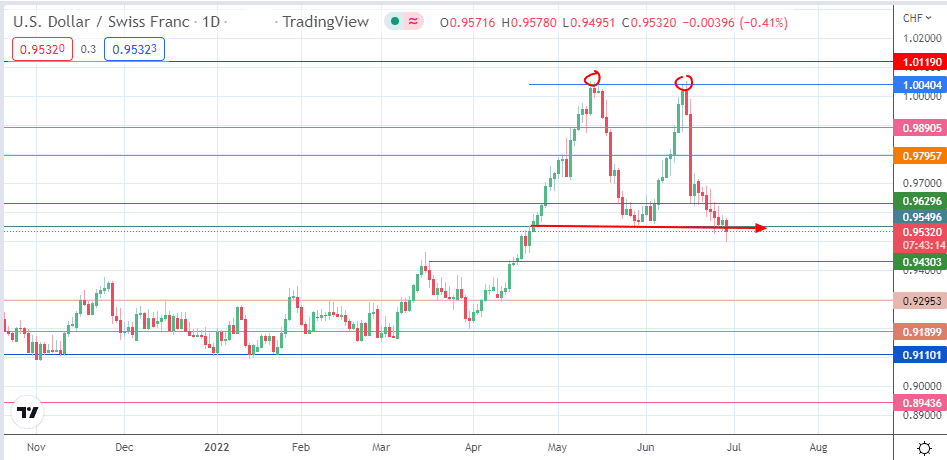

- The USDCHF is poised to move lower after the bears forced a breakdown of the critical neckline to confirm the double top pattern.

The USDCHF is down 0.48% on the day after risk-off sentiment took hold of the financial markets on Wednesday. However, the CHF has outperformed its peers on the day, allowing it to take control over a greenback that is mainly on a bid in today’s market sessions.

Comments from Chinese President Xi Jinping supporting his country’s current zero-COVID policy and strategy appear to have spooked the markets. This policy calls for severe lockdowns on detecting even a handful of cases, which could further worsen the outlook for commodities amid worsening business conditions in the global manufacturing industry. Recall that Eurozone manufacturing and services PMI data tested multi-month lows last week.

The risk-off sentiment comes off the back of a hawkish Swiss National Bank, which not only raised interest rates by 50bps but made commitments to up rates further if needed in an apparent abandonment of its usual dovish tilt. Technically speaking, this has manifested as further strengthening of the CHF, with a break of the critical neckline resistance, thus completing the double top.

USDCHF Price Action Forecast

As predicted in the last analysis piece for this pair, the double top has been confirmed by today’s breakdown of the neckline at the 0.95496 support. This move opens the door toward a measured move with 0.91899 as its completion point. The attainment of this downside target will depend on the bears’ ability to break down the support barriers at 0.94303 and 0.92953. An additional target at 0.91101 (3 January, 14 January and 24 January 2022 lows) exists if the price decline extends beyond the measured move’s completion point.

On the other hand, any form of recovery move has to come from a reverse break of the neckline, targeting a push above the 0.96296 resistance level (26 April, 26 May and 24 June 2022 highs). Above this level, additional targets are located at 0.97957 (2 May and 8 June 2022 highs) and 0.98905 (6 May and 19 May 2022 highs). A continued advance targets the double top at parity, with 1.01190 also serving as an additional target to the north.

USD/CHF: Daily Chart