- The USDCHF is pushing higher on the day as it breaks the saucer pattern, following a promise of currency intervention by the SNB.

The US Dollar continued its rebound over the Swiss Franc as the Swiss National Bank kept to its expansive rate policy intact. The SNB via its Chief Thomas Jordan said Switzerland’s economic downturn due to the coronavirus pandemic is not as bad as once feared. Jordan reiterated the maintenance of the negative rate policy and also stated the SNB would publish more information about its currency interventions.

Jordan also says that the SNB stands ready to purchase more foreign currency to stave off safe-haven pressure that would make the Swissy more expensive and stall the economic recovery of Switzerland.

These comments, made during the SNB Chief’s press statement following the rate decision, are now driving further weakness on the USDCHF, which is trading higher 0.33% higher on the day.

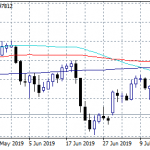

Technical Outlook for USDCHF

The USDCHF continues its breakout move from the previously identified saucer pattern, as the daily candle looks to reinforce yesterday’s upside penetration of the saucer’s lid. The pathway is now clear for the USDCHF to target the 0.93126 resistance target. Above this level, 0.94004 forms a new target, especially if the SNB delivers on its promise to purchase foreign currencies at the expense of the Swissy.

On the flip side, weakening of the upside move may produce a pullback to the 0.92264 support, with 0.91533 providing itself as an additional downside target. However, the tide is now with the bulls and interventionist action on the pair will only drive the upside push a lot further.