- The USD/SEK Exchange rates declined to the lowest level since June 29th as investors reached for the upcoming US nonfarm payrolls data.

The USD/SEK Exchange rates declined to the lowest level since June 29th as investors reached for the upcoming U.S. nonfarm payrolls data. The pair is trading at 10.13, which is significantly lower than this week’s eye of 10.69. Still, it remains about 24% above the lowest level in 2021.

U.S. nonfarm payrolls data

The USD to SEK exchange rates has been in an upward trend as investors focus on the strength of the U.S. dollar. The U.S. dollar index rose to the highest point in 20 years in July this year. The main reason for the rally was the extremely hawkish Federal Reserve. Last week the bank decided to hike interest rates by 0.75%, bringing the total year-to-date increase to 225 basis points.

The upcoming U.S. jobs numbers will be the next key catalyst for the USD/SEK exchange rate. Economists polled by Reuters Expect that the U.S. labour market continued to weaken in July this year.Precisely.They expect that the nonfarm payrolls dropped from 372 thousand. In June to two, 50,000 in July. They believe that the manufacturing sector created 17,000 jobs while the private nonfarm payrolls dropped to 230,000.

Other analysts expect that the unemployment rate remained at 3.6%, while the average hourly earnings dropped from 5.1% in June to 4.9% in July. This implies that U.S. inflation is growing at a faster pace than wages. Still, these numbers will likely not have an impact on the Federal Reserve, which has hinted that it will continue hiking interest rates this year.

In Swede, the Riksbank has also been extremely hawkish this year. It has increased interest rates several times in a bid to fight the soaring inflation. Data published by Sweden’s statistics agency showed that the consumer price index with fixed interest rates rose to 8.5% in June this year, up from 7.2% in May. On a monthly basis, inflation rates rose by 1.2% from May to June. This happened as food, electricity, and fuel prices rose in June.

USD/SEK forecast

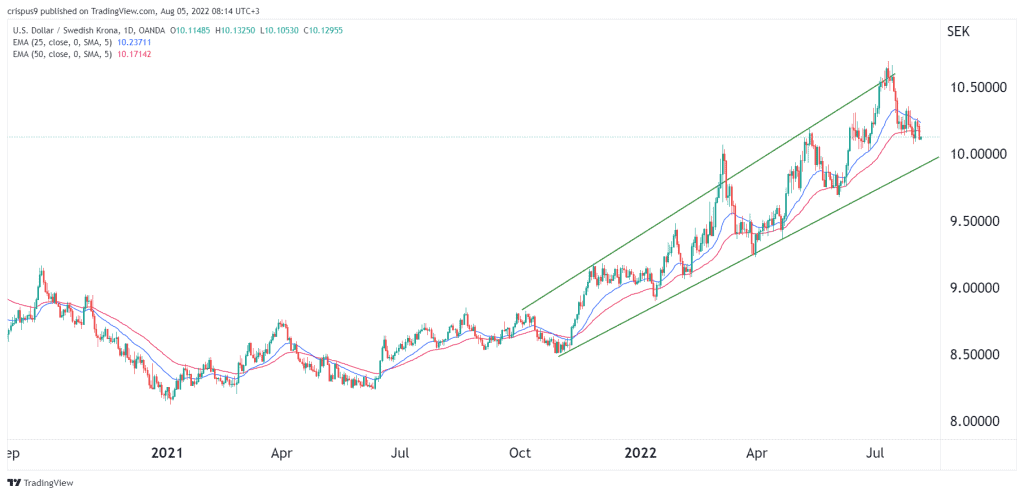

The daily chart shows that the USD/SEK exchange rate has been in an extremely bullish trend in the past few months. Along the way, the pair has formed an ascending trend channel that is shown in green. Recently, the pair dropped sharply after it tested the upper side of the channel. It has managed to move below the 25 and 50-day moving averages while the relative strength index are stilted lower recently.

therefore the pair will likely continue falling as sellers target the lower side of the channel at That’s 9.978. However, a break above the resistance at 10.28 will invalidate the bearish view.