- The USD/NOK price tilted upwards as investors reacted to the latest FOMC minutes and Norges Bank interest rate decision.

The USD/NOK price tilted upwards as investors reacted to the latest FOMC minutes and Norges Bank interest rate decision. The pair rose to a high of 9.7645, which was the highest level since August 9. It has risen by more than 3% from the lowest level this year.

Norges Bank rate hike

The USD to NOK exchange rate rose slightly after the decision by the Norges Bank to deliver its second interest rate hike this year. It hiked interest rates by 0.50% and hinted that it will continue the trend later this year. These rate hikes are necessary considering that Norway is seeing substantial inflation.

The Norwegian economy is facing numerous challenges. Its sovereign wealth fund lost over $174 billion in the first half of the year as global stocks collapsed. As a result, the fund erased all gains it made in 2021 as stocks jumped.

At the same time, Norway is going through a major drought that has pushed food prices sharply higher. Worse, it has led to low water levels that are affecting the country’s hydropower plants. Still, Norway is doing better than other European countries.

The USD/NOK price also rose after the Fed delivered minutes of the past meeting. The minutes showed that the bank will continue hiking interest rates in the coming months in a bid to lower inflation. Analysts expect that the bank will hike interest rates by 0.50% in September followed by two 25 basis points in the final two meetings.

USD/NOK forecast

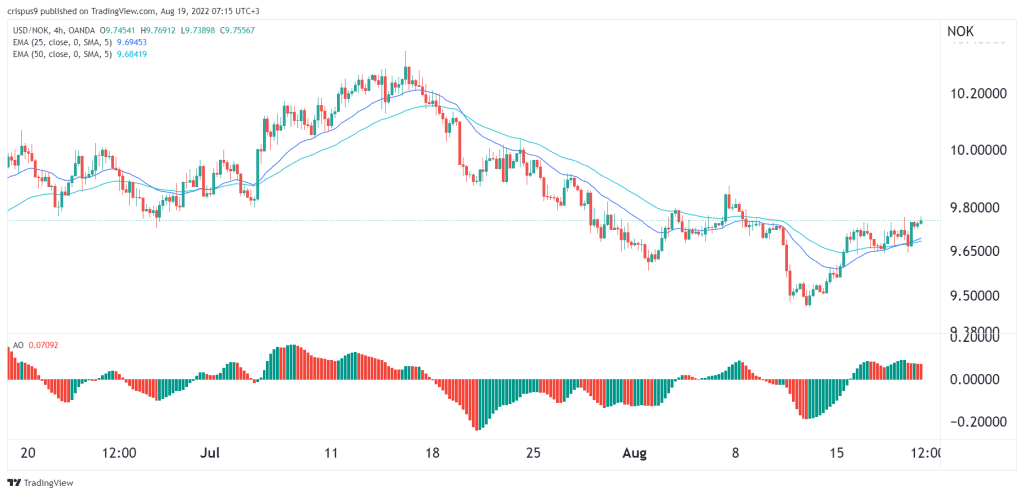

The four-hour chart shows that the USD to NOK exchange rate dropped to a low of 9.4566 on August 11. It has then made a steady recovery as the US dollar rises broadly. Along the way, the pair has moved above the 25-day and 50-day moving averages. This is usually a bullish sign. At the same time, the pair’s awesome oscillator moved above the neutral point.

Therefore, the USD/NOK price will likely keep rising as bulls target the next key resistance level at 10, which is about 2.8% above the current level. A drop below the support at 9.65 will invalidate the bullish thesis.