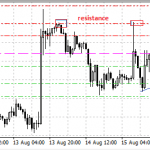

- USD/JPY remains bullish as it bounces from dynamic support. Moving forward, the pair may form a double top on the bigger timeframes.

The USD/JPY pair acted weirdly after the FOMC Statement and press conference from last week. It jumped close to one hundred pips on the announcement, just as the US dollar gained across the board. However, shortly after, the pair gave back all of its FOMC gains, despite the dollar continuing to strengthen against other currencies.

As such, the FX trading environment changed for the JPY crosses. More precisely, the EUR/JPY lost four hundred pips.

But on its way lower, the USD/JPY reached dynamic support below the 100 level. Since then, it bounced back, now threatening with a move above 111. This is where bearish interest should be noted, considering that on the bigger timeframes, the market may form a double top formation.

The Fed’s Powell testimony from yesterday made it clear that the Fed is in no hurry to raise the interest rates soon. As such, the USD may weaken on the back of investors pushing back expectations of the Fed normalizing the policies.

USD/JPY Technical Analysis

Bears may want to wait for a close above 111 before going short with a stop at 112 and a take profit at 107. Conservative bears may want to wait for a daily break below the rising trendline before shorting with a stop at the highs and a take-profit set by using a risk-reward ratio of 1:2.

USD/JPY Price Forecast

Follow Mircea on Twitter.