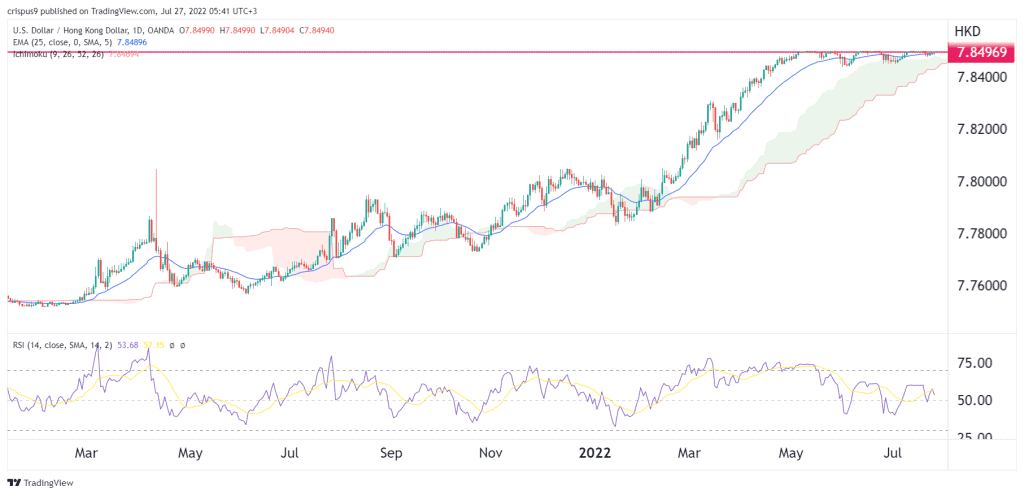

- The USD/HKD price moved sideways as investors continued to worry about the peg of the Hong Kong dollar. What next for the Hong Kong dollar?

The USD/HKD price moved sideways as investors continued to worry about the peg of the Hong Kong dollar. The pair is trading at 7.8493, which is slightly below the upper side of the peg of 7.8500. The next key catalyst for the pair will be the upcoming Fed interest rate decision scheduled for Wednesday. A rate hike will follow it by Hong Kong’s authorities.

Will the Hong Kong dollar peg stand?

Hong Kong is one of the most important cities in the world. International investors love the city because of its role as the gateway to China, the second-biggest economy in the world. It is also loved because of its stable currency.

The Hong Kong dollar is pegged to the US dollar. The HKMA works hard to ensure the USD/HKD remains in the 7.8500 and 7.7500 range. Furthermore, it ensures that this peg stand by selling or buying USD when conditions change.

With most emerging market currencies like the MXN and ZAR falling, the HKMA has been defending the HKD peg aggressively, leading some investors to worry about interbank liquidity. The authority has already spent about H$172 billion,, or $22 billion, to defend the peg. As a result, the aggregate balance has dropped to about H$165 billion.

As a result, the city’s interest rates have jumped sharply in the past few months. This trend will continue on Wednesday as the Federal Reserve is expected to hike interest rates by either 0.75% or 1%. Historically, the HKMA usually hikes rates when the Fed does so.

Some investors, especially Kyle Bass of Hayman Capital Management, have argued that the HKD will lose its peg in the next few years. However, the city’s foreign reserves of about $440 billion will likely help prevent that from happening. Also, the city is expected to see robust business activity as the city and mainland China reopen.

USD/HKD forecast

Technical analysis of the USD/HKD price is often not useful because of the existing exchange rate peg. However, as shown below, the pair rose sharply in the past few months as the HKD weakness continued. The sell-off then ended when it reached the upper side of the peg. Therefore, I suspect that the pair will remain in this range for a while as the Fed hikes rates and HKMA fights to maintain the peg.