- The USD/CAD price jumped to the important resistance level at 1.3080 as investors rushed to the safety of the US dollar.

The USD/CAD price jumped to the important resistance level at 1.3080 as investors rushed to the safety of the US dollar. The USD to CAD exchange rate is trading at 1.3033, which is about 1.70% below the lowest point on Friday last week.

Safety of the US dollar

The USD/CAD price rose sharply as the strength of the US dollar accelerated. The dollar index went parabolic and reached a multi-year high of $106. This happened as the dollar surged across the board, with the euro tumbling to the lowest level in over 20 years. The dollar also surged against most emerging market currencies.

The USDCAD price also rose sharply because of the performance of crude oil. Oil prices plunged on Tuesday a fears of a recession continued. Brent and West Texas Intermediate (WTI) declined below the important support of $100 for the first time in months. Oil prices have an impact on the Canadian dollar because of the amount of oil the country exports globally.

The next key catalyst for the USD to CAD exchange rate will be the upcoming FOMC minutes. The minutes will provide more color about the state of the economy and the actions that the committee will be willing to take. Jerome Powell and other officials have insisted that they will continue the hiking cycle soon.

The minutes will come a week before the Bank of Canada is expected to hike interest rates again. The committee has committed to keep hiking in a bid to lower inflation.

USD/CAD forecast

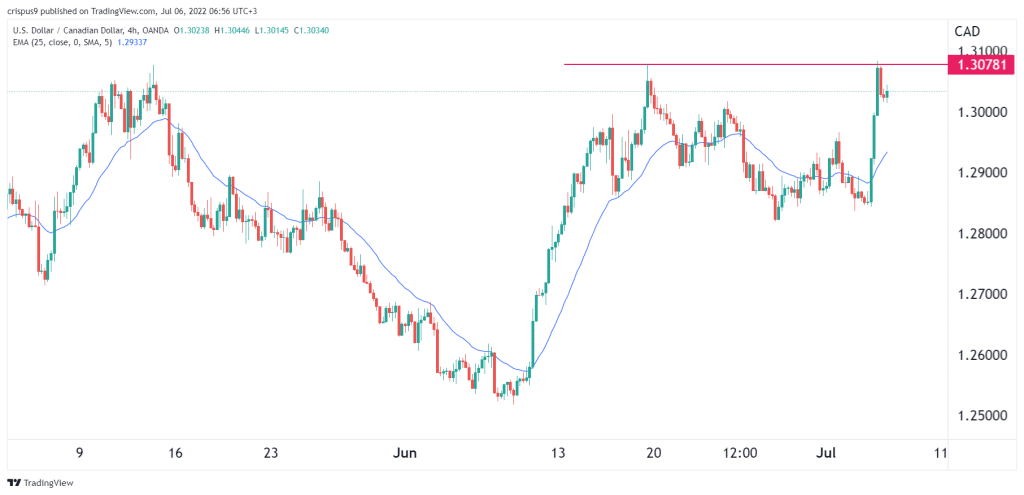

The four-hour chart shows that the USDCAD price went parabolic on Tuesday as demand for the US dollar rose. It reached a high of 1.3078, which was also the highest point on June 17th. At the time of writing, the pair was trading at 1.3023 as some buyers took profit. It remains above the 25-day and 50-day moving averages. Notably, the parabolic move was in line with what InvestingCube’s S&R indicator predicted on Tuesday.

Therefore, despite the pullback, there is a likelihood that the USD to CAD price will resume the bullish trend as bulls target the key level at 1.3100. A move below the support at 1.3000 will invalidate the bullish view.