- US Consumer Confidence dips below expectations in November; USDJPY down slightly on the news as holiday shopping season approaches.

The USDJPY is mildly off its intraday highs after the Conference Board announced that US Consumer Confidence index had fallen to 125.5, which was lower than the previous month’s 125.9 figure and lower than the consensus of 126.9.

With a deviation of -0.3 which was smaller than the tradable deviation of 1.0, the downside move on the USJPY was less than 10 pips, leaving the USDJPY trading at 190.03.

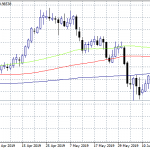

Technical Outlook for USDJPY

The near-term technical outlook for the USDJPY continues to remain neutral, following the failure of the US Consumer Confidence report to cause any real market volatility for this pair. With the Thanksgiving holiday approaching to kick off the holiday shopping season, volatility on this pair would likely come from trade headlines. This week, there has been very little on that front. ‘

The USDJPY is being supported by a near-term ascending support trendline, which connects the lows of daily price action from Nov 22 till date. This line is expected to provide support for intraday price action. A break below this trendline takes the USDJPY to 108.85 (central pivot). Below this level, 108.80 and 108.73 (intraday highs of Nov 20 and 22) remain short-term targets.

On the flip side, the main resistance level of 109.30 (August 1 and October 30 highs) remains. However, any recovery to the upside will have to pass through the R2 pivot of 109.15 to be able to test that major resistance area.