Late Tuesday, UK parliamentarians were able to defeat UK PM Boris Johnson in a late vote to stop the PM’s plan of exiting the EU without a transitional agreement. This defeat has forced Johnson to make a call for a snap election. The British Pound rallied on these developments, pushing up 0.9% from three-year lows of 1.1957 to test the descending trendline resistance at 1.2220. The Cable is presently trading at 1.2182 as at the time of writing.

Attention will shift slightly to the inflation report due in a few minutes, but developments surrounding Brexit will continue to dominate headlines. Major news from the US on Thursday and Friday, especially the Non-farm Payrolls may also play a role in price action for the rest of this week.

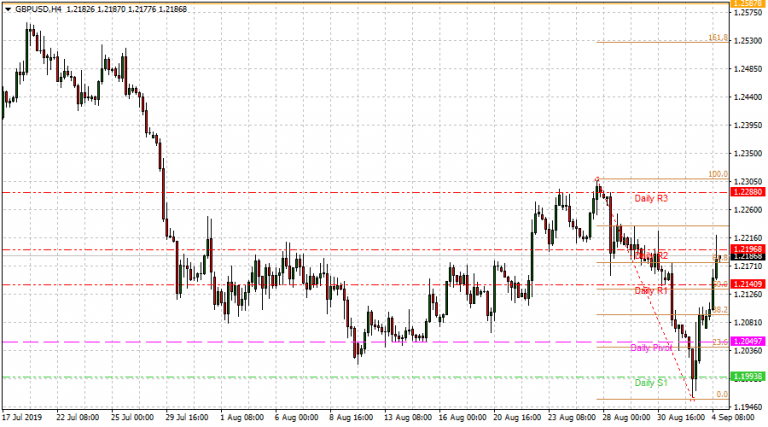

Technical Plays for GBPUSD

Technically speaking, the descending trendline on the daily chart which connects the highs of price action from May 3 till date continues to hold firm, after being tested by the latest rally in Wednesday London session trading.

Near term, we continue to see immediate resistance at 1.2229, which is the site of 78.6% retracement level drawn from the August 27 high of 1.23099 to the September 2 low of 1.19578). Above this level will open the door to the 1.2377 resistance (July 17 low in role reversal) seen on the daily chart. This will also mark a clean break of the descending trendline, with possibility for further upside recovery.

Failure to break the descending trendline or the 1.2309 price area will see a retest of support targets at 1.2102 and 1.2049, in that sequence. Further breaks below these areas will target 1.1986 (low of January 16, 2017).

Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.