- This article dissects the Tron price action, dives into recent news, and discusses the long-term technical outlook for TRX.

This article dissects the Tron price action, dives into recent news, and discusses the long-term technical outlook for TRX.

A slew of negative factors are currently weighing on Tron (TRX). The price is down almost 20% so far in December, extending the loss from November’s high to -43%. Furthermore, TRX is losing ground to rivals and is currently ranked the 25th most valuable cryptocurrency behind Bitcoin Cash (BCH).

Aside from the overall weakness of the cryptocurrency market, Tron is facing significant problems. In November, Etoro announced it would delist TRX for US customers due to regulatory concerns arising from Ripple labs case with the SEC. Furthermore, founder Justin Sun recently stepped down from his role as CEO of the Tron foundation to pursue a career as an ambassador for Grenada. As a result, TRX is floundering and starting to break down on the long-term charts.

TRX Price Forecast

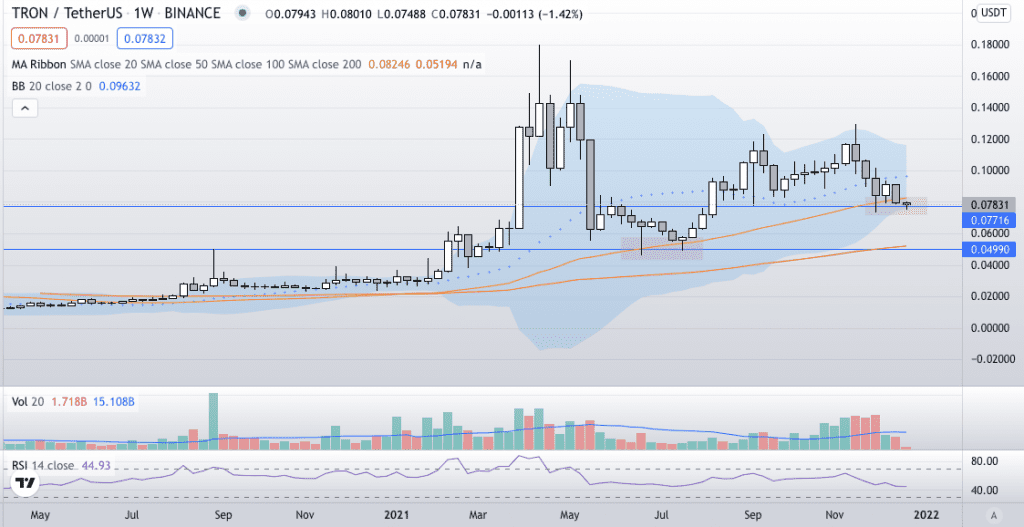

The weekly chart shows the Tron price ended last week below the 50-Week Moving Average at $0.0846 for the first time since June 2020. I consider closing below 50-WMA significant, especially considering the price action in July.

The Tron price traded below the long-term indicator during the summer but crucially ended the week back above. As a result, TRX gained around 125% over the two months that followed. Therefore, in my opinion, the path of least resistance is lower until TRX recovers the 50-WMA.

In light of the above and the broader macro threat to risk assets, I expect the price to bleed lower into Q1 2022, eventually testing the 100-WMA at $0.0520. However, TRX will avert the immediate danger if it recovers the 50-WMA on a closing basis. Therefore, a weekly close above $0.0846 invalidates the bearish thesis.

Tron Price Chart (Weekly)

For more market insights, follow Elliott on Twitter.