The Royal Dutch Shell share price is under pressure as investors remain worried about the company’s growth and its clean energy business. The RDSB share price is trading at 1,445p, which is slightly below last week’s high of 1,501p.

Natural gas to the rescue?

Shell’s fundamentals are relatively strong. Besides, the price of crude oil has pared back some of its recent losses and is currently a few points below its YTD high. This stability will help the company shore its balance sheet, increase returns to investors, and invest wisely in decarbonization.

Indeed, in reports last week, the IEA and OPEC all boosted their demand targets for the coming year, meaning that Shell and other global supermajors will benefit.

Shell also has another catalyst ahead. Natural gas. Shell is the biggest miner of natural gas globally, meaning that it will benefit as its price rises. Natural gas futures ended at $5.105 per million British thermal units, meaning that they have risen by about 17% this month.

Notably, this price has jumped in an offseason for demand, meaning that the price could get supercharged ahead of winter. Therefore, higher prices for both crude oil and natural gas will likely provide a major boost for Shell share price.

Shell share price forecast

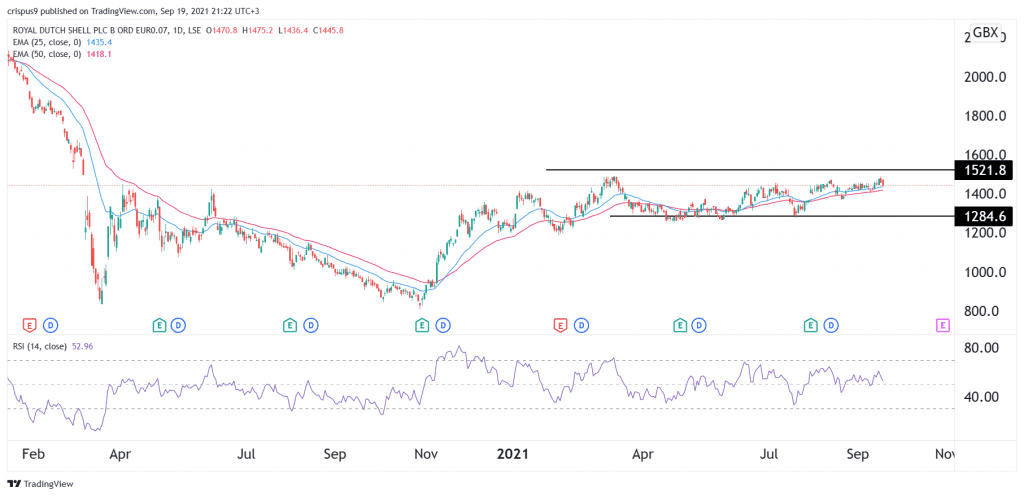

The daily chart shows that the RDSB share price has been in a tight range recently. The stock is trading at 1,445, which is a few points below the highest point last week. This price is also slightly below the year-to-date high of 1,521p. It remains along the 25-day and 50-day moving averages while the MACD are at a neutral level.

Therefore, while it is too early to tell, fundamentals will likely push the RDSB share prices higher. This view will be confirmed if it moves above the key resistance at 1,521p. On the flip side, a drop below 1,400p will invalidate the bullish view.