- Why has the Tesla share price pulled back? We explain whether now is the time to buy the TSLA dip or not and what comes next

The Tesla share price has dropped as investors in a broad market sell-off in the past few days. The TSLA stock is trading at $988, which is about 14.50% below the highest level this month. This drop has happened even after the company published a series of positive news. Still, the shares have jumped by over 42% from the lowest level this year. Its market cap has moved to about $1.06 trillion.

Tesla has made some positive headlines in the past few weeks. For example, on Monday, the firm said that it had shipped over 65,800 China-made cars in March. In addition, the company said that it sold over 314k deliveries in the first quarter. It delivered 184k cars in the same period in 2021. This increase was smaller than the median estimate of 317k. The firm attributed the performance to the ongoing supply chain issues.

Tesla announced that it was boosting the price of Model 3 Long Range by $1,500 and Model 3 by $1,000 in the US as it seeks to solve the current rising costs. Further, the company launched its massive Texas plant and announced that it deliver its CyberTruck in 2023. However, it has also faced some key headwinds, such as the ongoing Covid-19 crisis in Shanghai. The company has been forced to shut its plant in Shanghai because of the rising Covid crisis.

Still, analysts are optimistic about the company. For example, analysts at Wedbush expect that the Tesla share price will rise to $1,400, which is sharply higher than the current level. Likewise, those at UBS expect that the TSLA stock price will rise to $1,100, while those at Piper Sandler see it rising to $1,350.

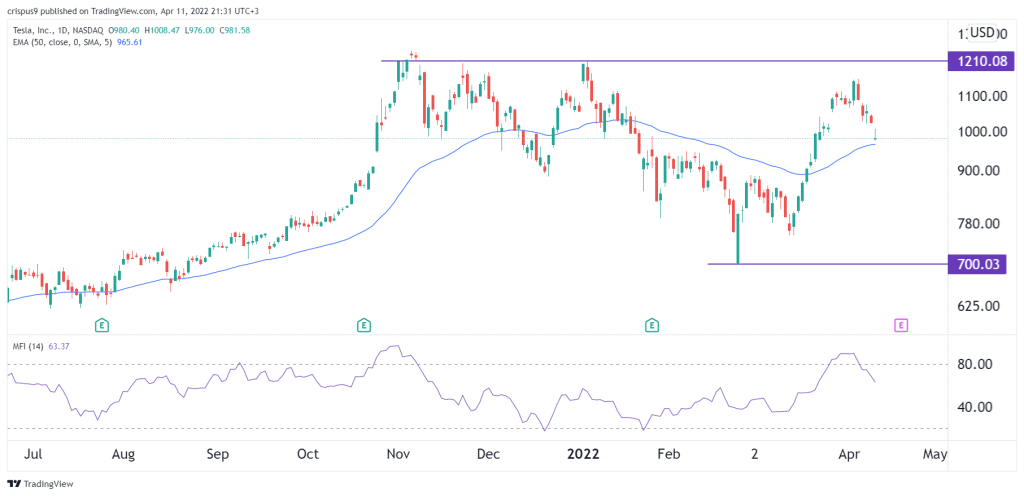

Tesla share price forecast

The daily chart shows that the TSLA share price found a strong resistance level at $1,210. This was the highest level in November last year. At the same time, the stock remains slightly above the 50-day moving average, while the Money Flow Index (MFI) moved below the overbought level to about 63.

Therefore, there is a likelihood that the Tesla stock price will likely drop for a while and then resume the bullish trend. The next key resistance level to watch will be at $1,210. A drop below the support level at $900 will invalidate the bullish view.