The Tesco share price has recovered in the past few days even as the state of the UK economy remains uncertain. The shares surged to a high of 256p, the highest level since June 9th of this year. This month, it has jumped by more than 5.60% from its lowest level and moved above the important resistance at 254p.

Retail concerns remain

Tesco is the biggest retailer in the UK, with more than 4,000 stores across the country. It employs over 367k people. Tesco’s main business is its giant supermarket stores. Its other businesses are its gas stations and Tesco Bank.

Tesco, like other retailers, has had a difficult year as consumer inflation slows and retail spending slows. The Tesco share price has collapsed by 10.48% year-to-date. Still, it has outperformed other global retailers like Kroger and Target. The closely watched SPDR Retail ETF (XRT) has dropped by more than 24%.

Recent data have not been encouraging. For example, the headline consumer price index (CPI) jumped to 9.1% in May as the cost of most items rose. At the same time, data published on Friday revealed that the country’s retail sales dropped sharply in May.

The company’s financial results have also been discouraging. Its comparable sales dropped by 1.5% in the first quarter. Still, the company decided to stick to its full-year forecast of adjusted retail operating profit between 2.4 billion pounds and 2.6 billion pounds.

The Tesco share price has dropped as investors expect that the company will experience thinner margins this year. The management has pledged to ensure that customers get the lowest price on key items.

While the outlook is still bearish, some investors believe that Tesco has become undervalued. For one, it has a strong UK brand and consistent returns. Further, according to Simply Wall St, the company is trading at a 52.7% discount on a DCF perspective. Its price-to-earnings ratio of 15.9x is still below the industry average of 15.9x.

Tesco share price forecast

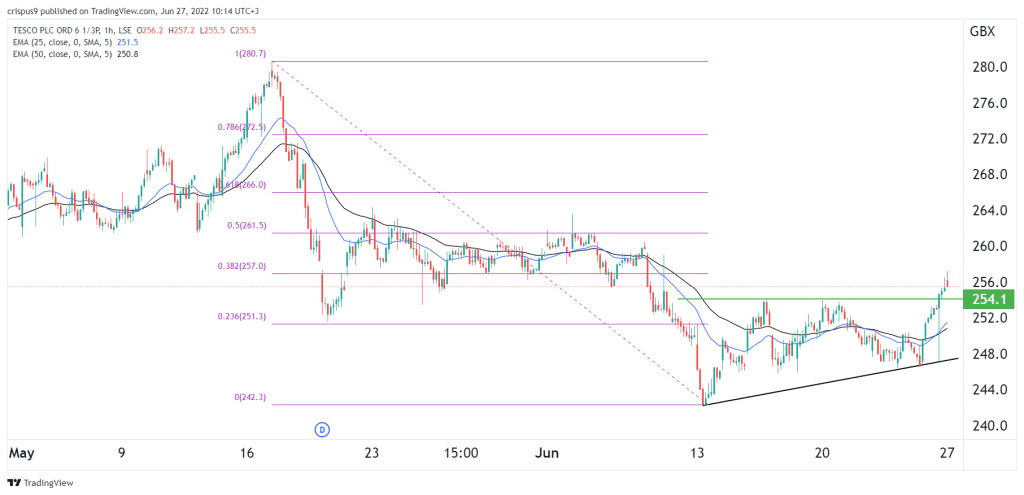

Turning to the hourly chart, we see that the TSCO share price has been in a strong bullish trend in the past few days. The stock managed to move above the key resistance level at 254p, the highest point on June 15th. It is also approaching the 38.2% Fibonacci retracement level. Also, it has risen above the 25-day and 50-day moving averages.

Therefore, the Tesco stock price outlook will likely keep rising as bulls target the key resistance at 261p, which is along the 50% Fibonacci retracement level. A drop below the support at 254p will invalidate the bullish view.