- Tesco share price has made a slow comeback in the past few weeks even as the outlook for the retail sector.

Tesco share price has made a slow comeback in the past few weeks, even as the outlook for the retail sector. The TSCO stock has risen from the year-to-date low of 242p to 260p. Still, the stock remains 14% below the highest level this year. Other UK retail stocks like Sainsbury’s and Marks and Spencer have also slipped.

Retail sector challenges

Tesco is the biggest retailer in the UK, with thousands of stores and a market value of over 23 billion pounds. The company also operates its gas stations and a bank, making it an integrated part of the economy.

2022 has been a difficult year for Tesco and other global retailers. While customer demand remains high, inflation has slowed down their spending. Recent data showed that UK’s inflation soared by 9.4% in June, the highest level over three decades. As a result, wages are growing at a significantly slower pace.

The most recent results showed that the company’s sales rose by 2% to £13..58 billion in the quarter to May. Its UK business had revenues of £12.59 billion while Central Europe’s revenue rose by 9% to £976 million. Most importantly, the company gained market share by about 37 basis points.

Other global retailers are also struggling. For example, in June, Target lowered its forward guidance and hinted that it will start offering discounts to deal with its high inventory. In addition, Walmart delivered weak results and warned about its inventory problems. Therefore, Tesco could also face a similar challenge.

Tesco share price forecast

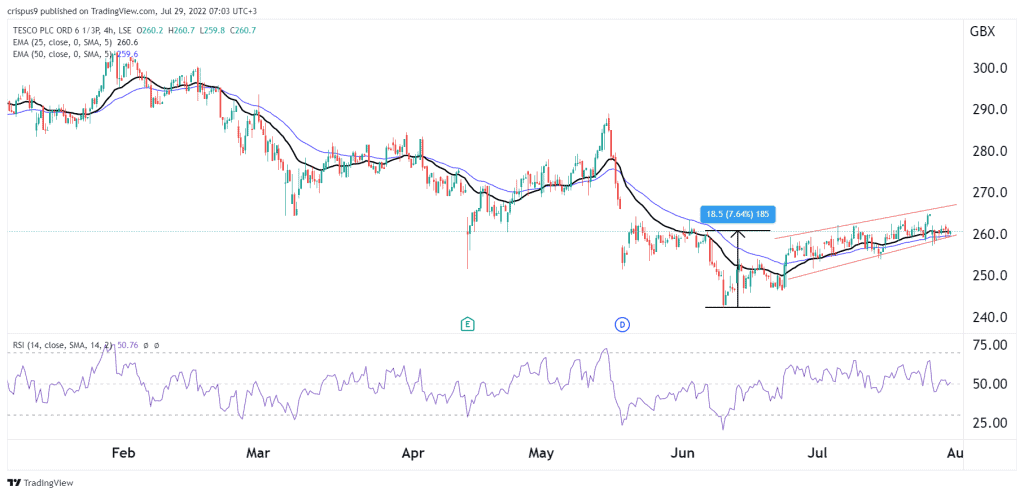

TSCO share price has risen by over 7.6% from its lowest level in June. This is a sign that investors welcomed the company’s results. In this period, it has formed an ascending channel shown in red. It is also consolidating along the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the neutral point.

Therefore, the shares will likely have a bearish breakout in the near term as the retail struggles continue. If this happens, the next key support level to watch will be at 250p. A move above the resistance at 265p will invalidate the bearish view.