- Tesco share price could shoot higher if the tender notes offering proposed by the company excites investors enough to snap up the stock.

Tesco share price is only mildly higher as the company prepares to launch tender offers for $3.5 billion. The tender offer will sell notes that will pay an interest of a maximum of 6.125%, with tenors lasting from 1 year to 22 years, and another offer for 750 million Euros, which has a tenor of 3 years and pays 2.5% interest. A third tender offer will see the supermarket chain offer $726 million dollars for 35-year notes, at 5.125% interest.

Investors’ approach to the stock on the day is mostly cautious, as the company continues to struggle with a string of negative news in its stores. Such news has ranged from a supervisor who contracted coronavirus during a store outbreak and has died, to customers in some Tesco stores disregarding COVID-19 prevention protocols.

Tesco currently trades at 242.4, or 0.11% higher.

Tesco Share Price Outlook

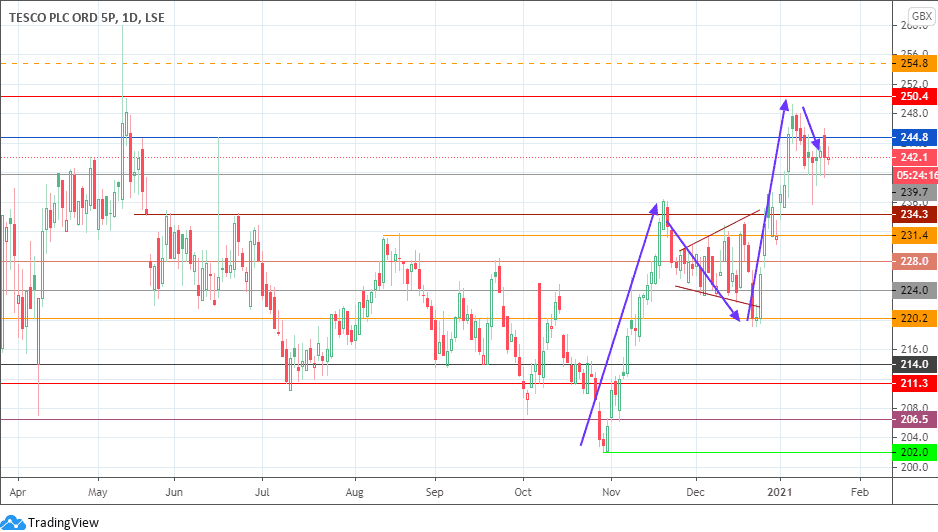

Tesco share price continues to trade in a range, which has as its ceiling, the 244.8 resistance, and 239.7 as its floor.

To break the range trade pattern and complete the 1-2-3-4-5 Elliot Wave pattern, price needs to turn bullish and beat the 7 January high in order to re-establish the 5th impulse uptrend wave. This has to follow a break of 244.8, allowing for Tesco’s share price to aim for the 250.4 resistance target. Above this area, 254.8 lines up as an additional target to the upside.

On the flip side, a breakdown of the floor of the range brings in 234.3 into the picture, with 231.4 and 228.0 lining up as additional downside targets. This move could also come as a corrective wave that follows a push towards 250.4, followed by a rejection.