- The USDCHF continues its upward march as the Swiss National Bank (SNB) doubles down on its rhetoric surrounding its use of periodic interventions.

The USDCHF continues to trade higher on Monday as commentary by key officials of the Swiss National Bank put the Swiss Franc on offer Friday. The bearish sentiment on the Swissy has carried on into the new week, with the greenback gaining 31 pips on a day US markets were shut for Labor Day.

Last week’s 100 pip gain on the USDCHF was triggered by comments from the SNB Vice-Chairman Fritz Zurbruegg, who hinted that the interventions as well as negative rate policy of the bank were fundamental to the Swiss economy. These comments were bolstered by Friday’s commentary as provided by the SNB Chairman Thomas Jordan, who doubled down on the use of currency intervention as a tool the bank uses to curtail strength on the Swissy from safe haven demand.

Technical Outlook for USDCHF

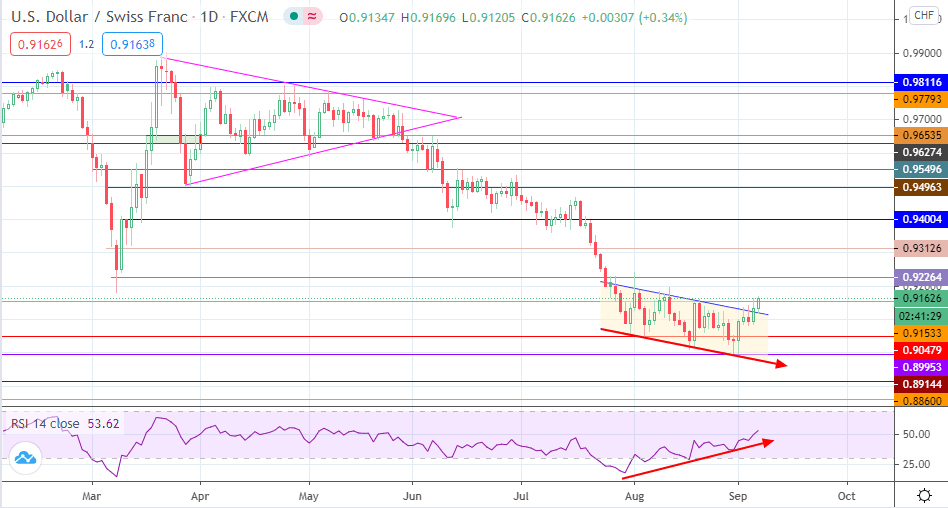

The pair has broken out of the channel and is also on the verge of breaking above the 0.91533 resistance level. Confirmation of the break of resistance has to come from a closing penetration above this price by tomorrow’s candle. If this is fulfilled, the pathway towards 0.92264 is cleared. 0.93126 may then serve as a potential future target.

However, if the breakout fails and a pullback occurs, we may see a retreat below 0.91553, targeting 0.90479 and possibly 0.89953 if price continues the march towards the channel’s lower border.

USDCHF Daily Chart