- The Solana Price-action will be dominated by several significant technical levels. Here we discuss some potential scenarios for SOL.

The Solana Price-action will be dominated by several significant technical levels. Here we discuss some potential scenarios for SOL.

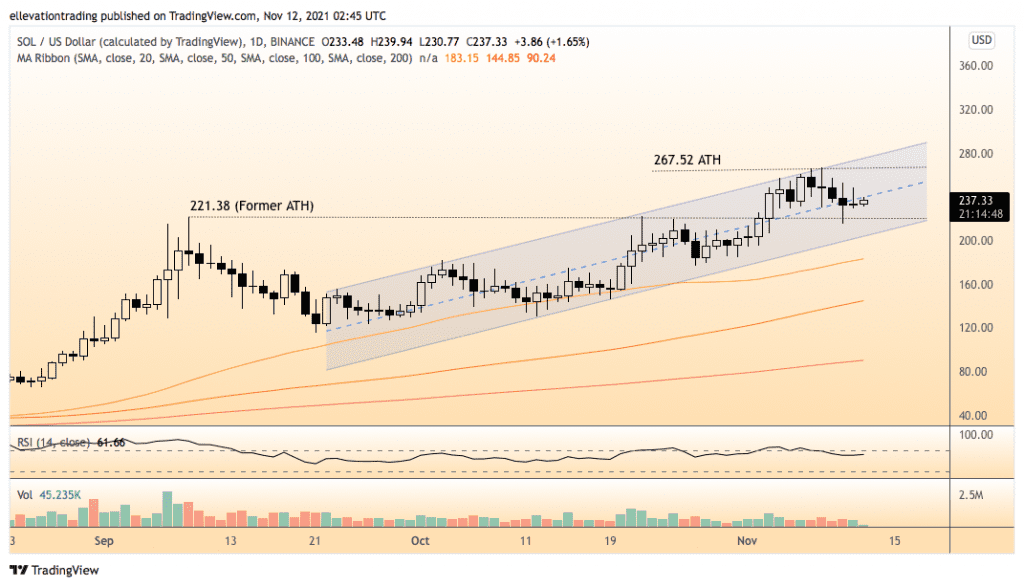

Solana (SOL) has been one of the best performing large-cap cryptocurrencies in the last few months. Over the weekend, the SOL token reached a record high of $267.52, increasing its year-to-date performance to more than +1,500%. The massive increase in Solana’s market cap to $72 billion has seen it flip Cardano (ADA) to become the 5th-largest cryptocurrency behind stablecoin Tether (USDT).

However, often during unabating bull-runs, it’s easy to get overconfident and complacent. That’s why, now more than ever, traders, especially those with paper gains, should pay close attention to the developing price-action.

Important Price Levels

The daily chart shows the Solana price is trending higher in a parallel trading channel. On the 8th of November, SOL set an all-time high at the top of the track before reversing 18.5% into yesterday’s low. However, the price steadied at the former ATH of $231.38, which becomes the first significant support level. If Solana closes below $231.38, it should extend towards the bottom of the channel at $204. And below $204, the 50-DMA at $183.10 and the 100 at $144.84 are potential downside targets.

The all-time high is the first logical resistance level, which, if cleared, should target trend resistance at $276. However, a new record could encourage an exaggerated extension into the $320-$340 range.

The immediate price action suggests we may see a test of trend support shortly. But taking into account the solid longer-term bullish momentum, technically, the path of least resistance is higher overall. However, traders should also consider the magnitude of the rally, which could leave SOL vulnerable to sharp shock lower. Furthermore, the optimistic scenario relies on Solana maintaining its uptrend, and therefore a close below $204 invalidates the bullish thesis.

Solana Price Chart

For more market insights, follow Elliott on Twitter.