Tesco shares are holding near record highs as the retail giant pushes ahead with its £1.45 billion share buyback programme, a move aimed at reinforcing shareholder value while maintaining balance sheet strength. The company recently cancelled another block of ordinary shares, adding to the more than 200 million already repurchased since the plan began.

The steady capital return comes as Tesco leans on its strong cash generation, sending a clear signal of management’s confidence in its long-term growth story. The ongoing buyback is also providing a price floor in the market, with institutional flows continuing to accumulate on every dip.

Why Tesco Is Taking Broadcom to Court

But while Tesco is rewarding shareholders, it’s also gearing up for a courtroom showdown. The supermarket chain has launched a £100 million lawsuit against Broadcom and Computacenter over a dispute involving VMware software licensing. Tesco claims Broadcom abruptly shifted from perpetual licences to subscription-based contracts and stopped providing critical updates on software it had already purchased.

According to Tesco, these changes could compromise the systems that run store checkouts and logistics, core technology that keeps its supply chain running smoothly. The case is still in its early stages, Tesco has cautioned that if it drags on without a resolution, it could disrupt critical systems and create operational risks for the business.

Tesco Maintains Grip on UK Grocery Market

Even with the legal battle brewing in the background, Tesco continues to tighten its hold on the UK grocery market. Its latest quarterly figures showed group sales climbing just over 5% year-on-year, with UK like-for-like food sales up 5.1% as volumes picked up.

Tesco has been quietly building momentum, lifting its market share to about 28% of the UK grocery sector. It has held its margins even as Asda pushed aggressive price cuts and discounters like Aldi and Lidl expanded rapidly. Tesco’s strength lies in its balance, keeping everyday prices sharp through its value ranges while growing its premium Finest line to capture higher-spending shoppers.

That mix has helped it keep customers loyal despite pressure on household budgets. With its scale, supply chain reach, and trusted brand built over decades, Tesco still holds a firm advantage in a fiercely competitive market.

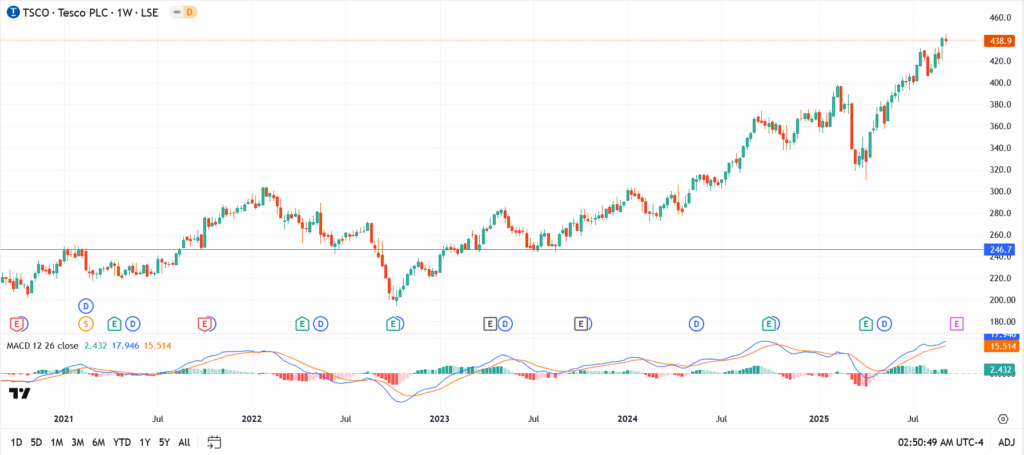

Tesco Chart Analysis

- Current price: 438.9 p

- Support: The 430-435 p band is acting as the first support area. A deeper base sits near 420p.

- Resistance: 445-450 p, which could cap short-term rallies.

Trade entry: Short-term traders may look for pullbacks into the 430-435 p range as a potential entry if support holds. A drop under 430 p would open risk toward 420 p.

Tesco Stock Outlook Amid the Legal Battle

Tesco’s share price strength reflects more than just market optimism, it shows trust in the company’s ability to keep delivering. Solid sales growth, rising market share, and a steady buyback programme have given the stock a firm base, even as competition stays fierce.

The legal dispute with Broadcom adds a layer of uncertainty, but it hasn’t dented Tesco’s operational momentum. If the company carries this performance into the busy holiday season, the stock has room to push beyond the 450 p zone.

For now, Tesco looks well-positioned, a business with stable cash flows, pricing power, and a clear focus on rewarding shareholders, even while navigating a challenging retail landscape.

Tesco has filed a £100 million lawsuit against Broadcom, alleging it changed VMware software licences from one-time purchases to expensive subscriptions and stopped providing updates. Tesco says this could threaten key systems that run its logistics and checkout operations.

Tesco remains the UK’s biggest supermarket, holding close to 28% of the market. In its most recent quarter, sales rose a little over 5% from last year as more shoppers filled their baskets and the retailer struck a strong balance between its value ranges and the higher-end Finest line

Tesco is up against intense competition from Asda, which has been pushing aggressive price cuts, and fast-growing discounters Aldi and Lidl. Even so, Tesco has held its margins by leveraging its scale, efficient supply chain, and long-standing customer loyalty.