- Tesco share price hits its highest level since 2008, up over 40% in 2025. Can Clubcard data, value focus, and diversification keep the rally ?

Tesco (LSE: TSCO) is finally rewarding patient investors with something they haven’t seen in years, fresh highs. The stock climbed to £4.42, a level last touched back in 2008, after rallying more than 40% since the start of 2025. For Britain’s biggest supermarket chain, it’s a remarkable turnaround story. The company has spent much of the past decade fending off squeezed margins, cut-throat price wars with discounters, and doubts over whether it could ever win back investor trust.

What’s driving the surge?

The UK food retail market is characterized by a supportive consumer environment, strong trading, and strict financial discipline. Traders and long-term investors are being forced to reevaluate Tesco’s position in their portfolios as a result of the company’s share price breaking through levels that have capped rallies for years.

Why Tesco’s Rally Matters

Tesco’s strength in 2025 is underpinned by fundamentals rather than hype. Management has doubled down on value-for-money positioning at a time when UK households remain cost-conscious. The company’s Clubcard-driven loyalty strategy has not only boosted traffic but also helped Tesco gather valuable consumer data that sharpens pricing and promotions. That edge has allowed Tesco to defend its market share against Aldi and Lidl, which had once looked unstoppable in the discount space.

The company’s most recent financial updates added fuel to the rally. Q1 numbers showed revenue growth that outpaced inflation, supported by volume gains, a crucial indicator that Tesco is not just raising prices but also selling more goods. Management reiterated full-year guidance of £2.9 billion in operating profit, a figure that convinced analysts to raise their price targets through the summer.

Another driver has been capital returns. Tesco is in the middle of a £1.45 billion share buyback program running through April 2026, with a significant portion already executed. By canceling shares at a time when earnings are climbing, Tesco has effectively lifted EPS growth, bolstered valuations, and attracted institutional inflows.

Tesco Share Price Chart Analysis

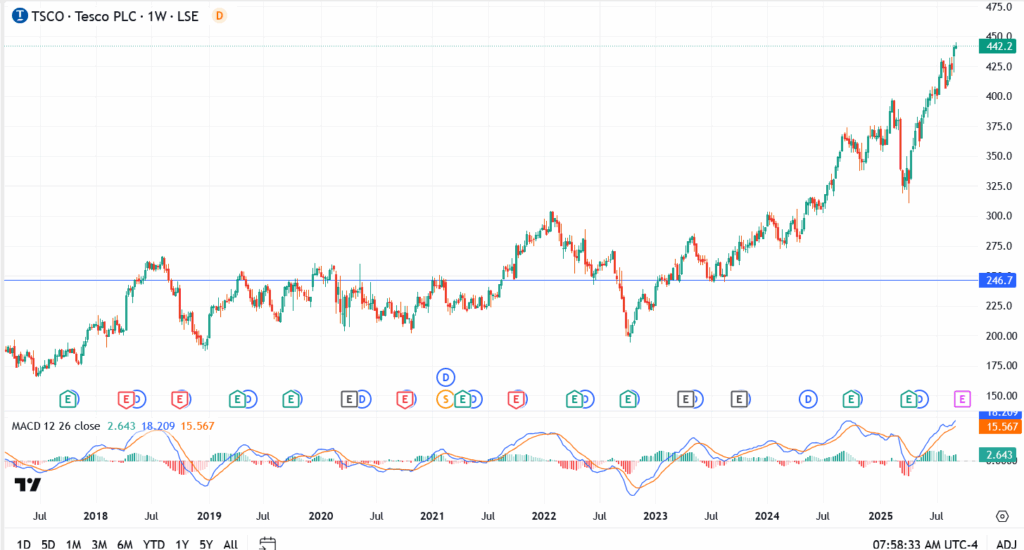

- Current Price: £4.42

- Resistance: £4.50, then £4.72

- Support: £4.25, followed by £3.95

Entry Point for Traders: A sustained close above £4.50 could open the door to fresh highs, while a slip below £4.25 risks a pullback toward £3.95.

Outlook: Can the Momentum Last?

Looking ahead to Q4 2025, Tesco’s outlook remains constructive but not without risks. If UK food inflation slows too sharply, nominal growth could cool, even if volumes remain steady. On the other hand, a softer inflation backdrop may improve sentiment for consumers and further support Tesco’s “value plus quality” positioning.

What’s clear is that Tesco is no longer simply surviving the discount invasion or fighting off margin erosion. It is winning back credibility. The stock’s return to pre-financial crisis levels is symbolic, a reminder that market leaders can recover when they combine scale with discipline.

For long-term investors, the structural strengths are compelling: a dominant UK footprint, sticky customer loyalty, steady dividend policy, and smart capital allocation. For traders, the breakout has made Tesco a momentum name on the LSE, and the chart suggests the bulls are still in control, at least for now.

Tesco’s Clubcard pricing and scale are giving it an edge. Asda is fighting back with aggressive discounts, while Aldi and Lidl remain strong on price, but Tesco’s ability to balance value with range is helping it hold the line. The loyalty data it collects also keeps promotions sharper than what discounters can easily replicate.