- Rolls-Royce stock steadies near £1,050 after last week’s sell-off. Can bulls defend £1,000 support or is the 2025 rally losing momentum?

The Rolls-Royce (LON: RR) share price is trading near £1,051 on Tuesday, consolidating after last week’s sector-wide sell-off that knocked almost 6% off aerospace and defence stocks. Despite the pullback, Rolls-Royce remains one of the best-performing FTSE 100 names in 2025, having surged over 120% from last year’s levels. The question now is whether this rally has more fuel or if valuations are stretched.

Why Did Rolls-Royce Stall Near £1,050?

The weakness across the aerospace and defence sector last week was linked to heightened geopolitical tensions and profit-taking after a strong summer run. While peers also declined, Rolls-Royce stood out as the hardest hit, sparking debate on whether momentum investors are unwinding positions. The stock’s rapid rise has left it trading at valuation multiples some analysts believe are difficult to sustain without further earnings upgrades.

Key Technical Levels to Watch

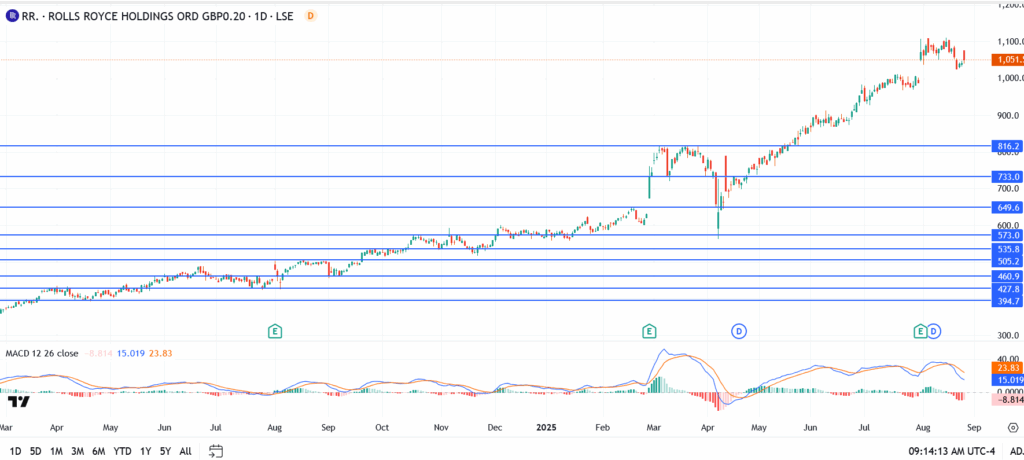

The chart highlights a crucial battle:

- Current price: £1,051

- Resistance: £1,084, followed by £1,150 if bullish momentum resumes

- Support: £1,000 psychological level, then £950 and £816 on deeper pullbacks

- Momentum: The MACD shows fading upside, suggesting consolidation rather than outright reversal

If the bulls can defend £1,000, another leg higher remains possible. A failure there could open the door to a sharper retracement toward £950.Why Rolls-Royce Share Price Matters for Investors in 2025

Why Rolls-Royce Share Price Matters for Investors in 2025

Rolls-Royce’s rally has been underpinned by strong fundamentals, including record order books for its civil aerospace unit, a push into defence contracts, and renewed attention on nuclear energy projects. But with the share price already pricing in much of the optimism, investors are now weighing whether further upside requires fresh catalysts, such as contract wins, policy tailwinds for defence, or stronger free cash flow guidance.

Conclusion

Rolls-Royce has been one of the UK market’s standout stories, but the test at £1,000–£1,050 will reveal if this is a pause or the start of a correction. Will buyers step back in at support, or is the stock finally running out of altitude after a year-long climb? Investors should watch both the technical levels and upcoming news flow closely before making their next move.