Rolls-Royce eased about 1 percent today as traders stepped back to reassess how much good news is already baked in. The stock has been a headline maker all year, fuelled by cleaner execution, a fatter order book in defence, and healthier civil aerospace margins. That backdrop has not changed. What is changing is the conversation around price. After a relentless climb into four digits, buyers are asking for fresh catalysts before they press the accelerator again.

Management’s turnaround playbook is working. Costs are tighter, cash generation looks sturdier, and guidance has marched higher. Those wins earned the share price its sprint. They also raised the bar. At these levels the market is paying for delivery, not promises, which is why every whisper about valuation now gets a louder audience. None of this says the trend is broken. It says the rally has shifted from easy mode to prove-it mode.

What is driving the Rolls-Royce share price right now?

Tape action was calm rather than bearish. Bids sat beneath the market and sellers were selective, more profit taking than panic. That tone fits a stock consolidating near highs rather than one rolling over. If management continues to show discipline on margins and cash, the bull case stays intact. Miss a step and the air gets thin quickly.

Rolls-Royce Share Price Analysis

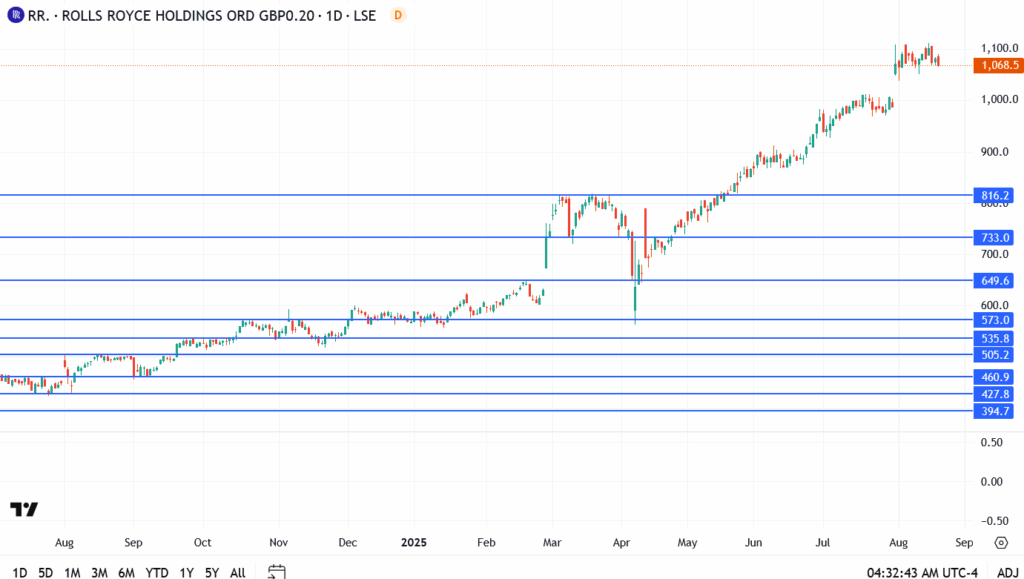

- Current price: £1,068

- Pivot level: £1,060

- Immediate resistance: £1,084, then £1,093

- Support: £1,055, then £1,020; deeper cushion sits near £816, the prior breakout shelf

Price is hovering just above the pivot after last week’s stall. A firm push through £1,084 would tilt momentum back to the upside and put £1,093 on the radar. Lose £1,060 on a closing basis and the market will likely probe £1,055; a decisive break there opens a drift toward £1,020. Only a sustained move below that level would risk a larger unwind toward the old £816 base.

Can Rolls-Royce shares break above the 1,075p level?

The story is still attractive. Defence visibility is improving, civil flying hours are recovering, and leadership has kept a tight grip on costs. The challenge is valuation. At this altitude the stock needs clean execution to justify every extra pound. For now, as long as £1,060 holds, dip buyers have room to work. Two strong closes above £1,084 would change the tone quickly. Until then, it is a patience trade: disciplined entries, tight risk, and eyes on delivery rather than headlines.