PC Jeweller (NSE: PCJEWELLER) extended Friday’s pullback on Monday morning, dropping 3% to ₹16.79. The drop comes just days after the stock surged to ₹19.80, marking a staggering 75% rally from late June lows. So why are investors hitting the brakes now, even as the company announces a big funding round and solid revenue growth?

The jeweller secured ₹500 crore in funding last week, aiming to shore up its working capital and accelerate expansion. On top of that, management revealed a sharp 80% jump in Q1 FY26 revenue, signaling a strong operational rebound.

Still, investors aren’t convinced. There’s no update on net profit margins or bottom-line growth, and the new capital raise could dilute equity in the near term.

A revenue beat is welcome, but the silence on profits and the dilution risk from fresh capital is weighing on sentiment,”

said a Mumbai-based fund manager.

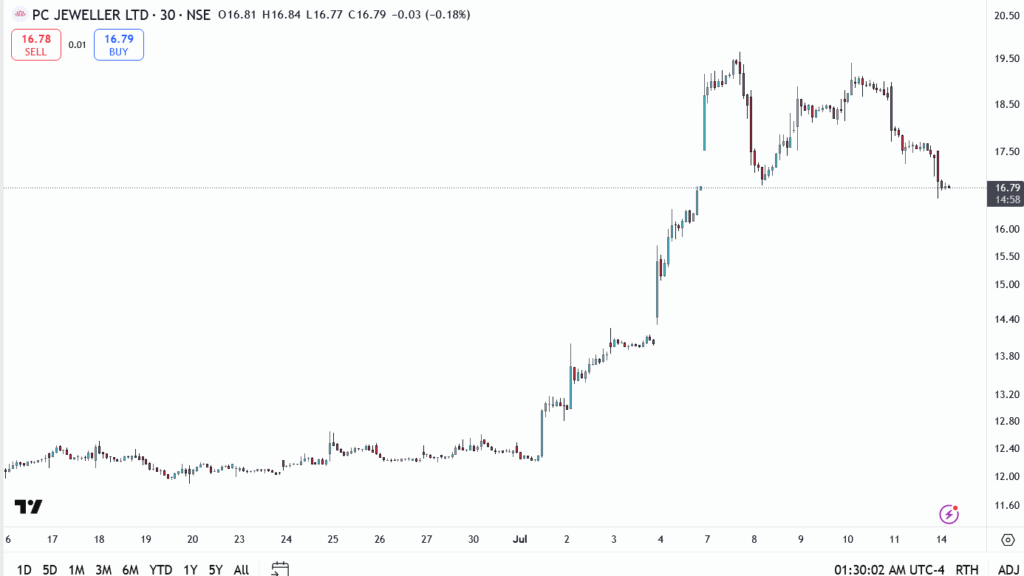

PC Jeweller Technical Chart: Exhaustion After Euphoria

The stock chart shows a parabolic run-up followed by two sharp rejection candles near ₹20. A classic profit-booking pattern is now playing out.

- Current Price: ₹16.79

- Resistance: ₹18.80, ₹20.50

- Support: ₹16.20, ₹14.40

- Trend: Near-term bearish bias below ₹17.50

Conclusion

Without more clarity on profit margins or a clean balance sheet update, Monday’s drop could be just the beginning of a broader consolidation.

Bulls need to reclaim ₹18.80 fast to reignite momentum. Until then, PC Jeweller is drifting back into high-risk territory.