Nvidia (NASDAQ: NVDA) tumbled to $169 in Tuesday’s trade, breaking below its short-term support zone as surging U.S. bond yields spooked investors across the tech sector. The drop adds to last week’s post-earnings weakness and raises questions about whether the AI leader can quickly regain its footing in a market turning cautious.

Why Nvidia Stock Price Falling?

Traders had already been uneasy after Nvidia’s Q2 results failed to extend its record-breaking streak of upside surprises. While revenue and earnings beat expectations, signs of moderating data center growth triggered profit-taking. Now, higher Treasury yields are amplifying the selloff by making growth stocks less attractive relative to bonds.

Adding to sentiment, headlines around Alibaba’s AI chip push and Abu Dhabi’s G42 diversifying its supply chain away from Nvidia chips continue to remind markets that the company’s dominance faces more competition than in the past two years. Together, these forces are testing Nvidia’s premium valuation just as the broader tech trade shows cracks.

Nvidia Chart Analysis

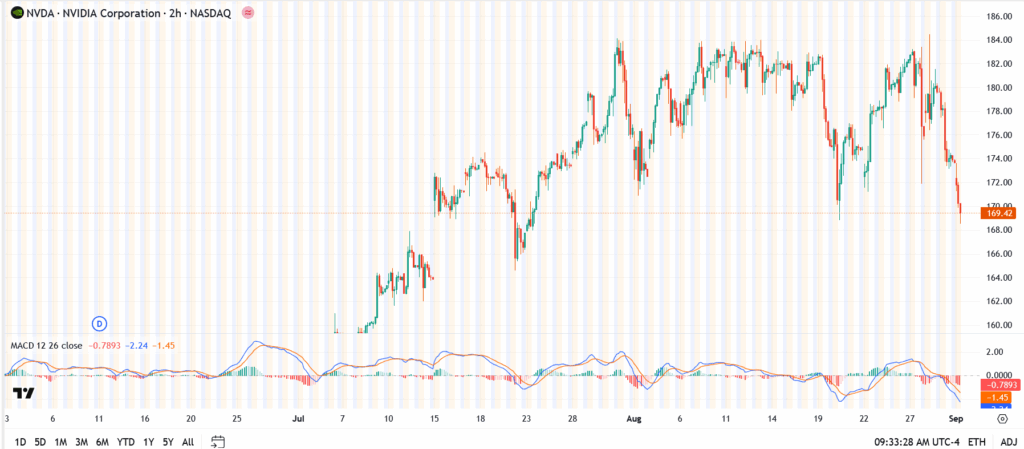

- Current price: $169.42

- Support: The $170 level just broke. Next downside levels sit at $164, then $160.

- Resistance: First hurdle at $175, then $181–$185.

- Momentum: MACD turned sharply negative, confirming that sellers are in control for now.

The stock has lost over 9% from last week’s high, and the technical breakdown at $170 could invite more short-term pressure if bulls don’t step in soon.

Outlook: Can Bulls Rebuild Confidence?

For long-term investors, Nvidia remains the undisputed cornerstone of AI infrastructure, with its Blackwell architecture and commanding GPU share. But short-term risks have piled up. A mix of rising yields, foreign competition, and cautious forward guidance means traders are less willing to chase new highs.

The near-term battle will be fought at $164–$165. If Nvidia holds, bulls may frame this as a healthy reset within the broader AI rally. A deeper breach, however, could shift the narrative from consolidation to correction, forcing Wall Street to reconsider how much growth is already priced in.

The pullback has put Nvidia back near the $170 zone, a level that traders see as a short-term support. But valuation remains stretched, with the stock trading at about 38 times forward earnings. That leaves investors torn: buy the dip and ride the AI theme, or wait for a cleaner entry if bond yields keep pressuring tech. For most, the timing question boils down to risk appetite, you’re paying a premium for leadership in AI, but the volatility around September’s macro data could still shake things up.

That’s the debate gripping Wall Street. Bulls point to relentless AI demand, while skeptics argue data center growth is showing early signs of plateauing. Add in U.S. export restrictions to China and the arrival of local chip competitors, and the headwinds become harder to ignore. The consensus isn’t that Nvidia’s story is over, far from it, but that the easy hyper-growth phase may be fading, leaving investors to adjust expectations to a steadier, more cyclical trajectory.

This is the stat everyone throws around: a $10,000 bet on Nvidia in 2015 would now be worth roughly $3.2 million. It’s the kind of return that cements a stock’s legend status and explains why long-term holders rarely flinch at 10–15% corrections. But it’s also a reminder, the past decade was supercharged by gaming dominance, crypto cycles, and the AI boom. Matching that pace from here will be tougher, even if the company continues to deliver industry-leading innovation.