Nvidia (NASDAQ: NVDA) delivered better-than-expected Q2 earnings, but the stock initially tanked as traders latched onto signs of cooling in data center growth. Shares slid as far as $168 in after-hours trade before buyers stepped back in. Nvidia has clawed its way back to $181 as of writing, setting the stage for a debate: was the dip just a shakeout, or a warning that the AI trade is losing momentum?

What Did Nvidia Report?

The chipmaker posted $46.5 billion in revenue, up 55% year-on-year, slightly ahead of consensus estimates. Adjusted EPS came in at $1.01 per share, also topping forecasts. While the numbers confirmed Nvidia’s role as the dominant player in AI hardware, investors drilled into the details, particularly a sequential slowdown in data center sales. That was enough to spark a knee-jerk selloff before dip-buyers steadied the stock.

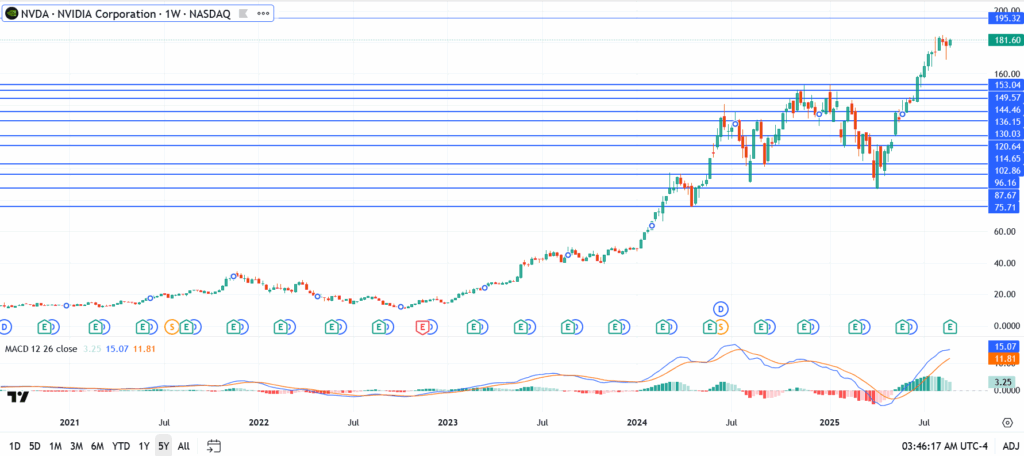

Nvidia Chart Analysis

- Low: $168 after earnings, wiping nearly 15% off the stock at its worst point.

- Current price: $181.60, returning to the previous trading range.

- Support: $173 in the short term, with $164 as the next mark if selling pressure increases.

- Resistance: $195 is the threshold bulls must regain to restore momentum

How Nvidia Share Price Moves Impact the Broader Market

Nvidia’s results are no longer just about one company. With the stock carrying massive weight in the S&P 500 and Nasdaq, its swings ripple across the broader market. A decisive recovery would help sustain the AI-driven rally in tech, while a failure to hold above $173 could trigger another round of risk-off sentiment.

Conclusion

Nvidia’s Q2 numbers beat expectations, but the real story is in the price action. A plunge to $168 followed by a sharp rebound to $181 shows this stock is still the heartbeat of the AI trade. The question now is whether buyers have the conviction to push NVDA through $195 or if the earnings glow fades into consolidation.

Despite topping estimates, investors drilled into the details. Data center sales, the engine of Nvidia’s AI dominance, showed signs of slowing sequentially. That raised concerns that hyperscalers like Amazon and Microsoft are moderating orders, sparking a selloff even as headline revenue and EPS beat forecasts. In short, the bar was so high that “good” numbers weren’t enough.

The bounce from $168 to $181 highlights strong dip-buying interest. For short-term traders, $173 is now the line in the sand, hold above it and the recovery case stays alive, with $195 as the next target. Long-term investors see the pullback as a reset, not a reversal, but risks remain if data center demand cools further.

Yes, but it depends on catalysts. Nvidia is still the face of the AI trade, with unmatched positioning in GPUs and enterprise demand. If momentum in AI infrastructure spending picks up again, NVDA could retest its highs before year-end. However, a failure to reclaim $195 in the near term would likely mean a period of sideways consolidation before the next leg higher.