Jio Financial Services (NSE: JIOFIN) Q1 earnings and growing excitement around its partnership with BlackRock are making the news. The company posted a 47% increase in revenue, reaching ₹612 crore, while net profit came in at ₹325 crore, a 3.8% rise from last year. The stock reacted swiftly, climbing to ₹330 before easing to around ₹316 in the latest session.

Even with this short-term pullback, the mood around JFSL remains upbeat. A strong 52% growth in net interest income and fresh regulatory approvals for its mutual fund, broking, and payments ventures are fueling optimism for the long term. Searches for “Jio Financial share price target”, “Jio Q1 results”, and “Jio BlackRock news” are all trending, investors are paying attention.

BlackRock JV and ₹17,000 Crore Inflows Push Sentiment Higher

Jio’s partnership with BlackRock is now a market-moving catalyst. The duo recently raised over ₹17,000 crore ($2.1 billion) through their first mutual fund offerings. Analysts see this as a potential disruptor in India’s asset management industry, thanks to its ultra-low-cost model. Regulatory greenlights for expansion into broking and payments have only strengthened the bullish outlook.

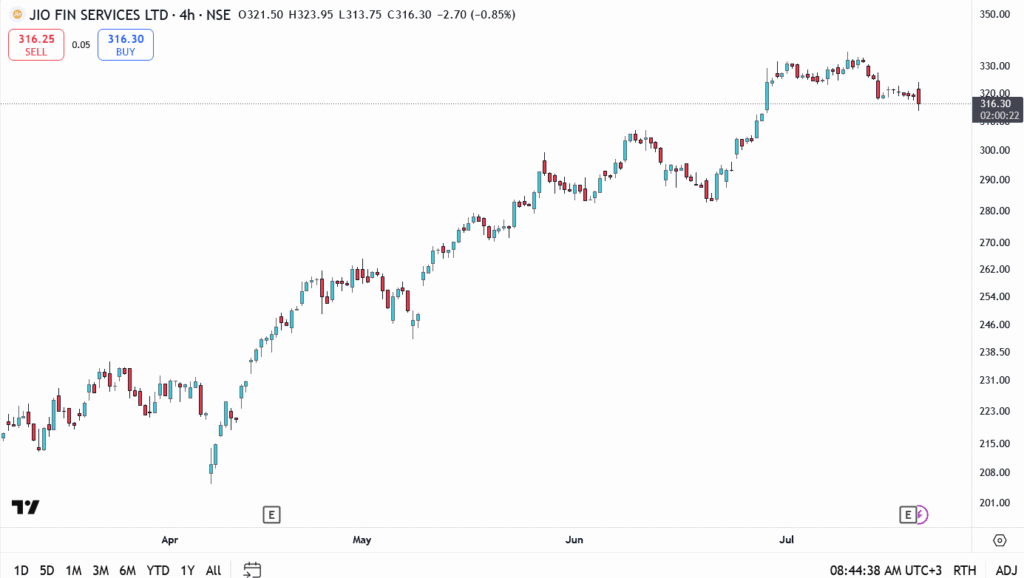

Jio Financial Share Price Chart Analysis

- Current price: ₹316.30

- Immediate resistance: ₹325

- Next key resistance: ₹334

- Upside breakout zone: ₹350 (if ₹334 is breached)

- Near-term support: ₹307

- Stronger support: ₹290 (post-earnings floor)

- Trend: Still bullish above ₹307, mild pullback from recent high

- Structure: Higher highs and higher lows remain intact

Final Word

Momentum may have paused, but the broader trend hasn’t flipped. If bulls reclaim ₹325 with strong volume, Jio Financial could quickly retest ₹334 and attempt a clean break toward ₹350. With institutional money flowing in and regulatory doors wide open, this stock still looks like it has unfinished business on the upside.