- The USDCHF pair is trading towards the 2015 lows on the back of extended bearish sentiment on the US Dollar as well as safe haven demand for the CHF.

Renewed US Dollar weakness as well as resumption of safe haven flows have sent the USDCHF towards multi-year lows. The USDCHF is down for the 4th consecutive day and is now touching off lows last seen in 2015 after risk-off sentiment creeped into Monday’s trading session.

The US Dollar remains pressured by market fundamentals. Postponement of last week’s US-China talks about the Phase 1 deal, as well as President Trump’s decision to go after other Chinese-owned companies such as Alibaba is seen as a factor that could further escalate already poor US-China tensions and could continue to be a negative for the greenback. Furthermore, it enhances risk-off sentiment, promoting Swiss Franc demand. Other risk-off sentiment factors are the continued global escalation of coronavirus cases, tensions around Brexit and the emerging US political situation with mere months to the US elections.

The market situation is such that sentiment around the US Dollar is so bearish at the moment, the Swiss Franc basically has to do nothing and yet USDCHF weakness may persist in the short-term and medium-term. The pair is down 0.29% so far this week, with the pair on the path to a 9th consecutive weekly loss.

Technical Outlook for USDCHF

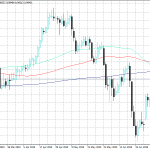

The pair is contending with the 0.90479 support level, which has so far held for the past 4 weeks. A breakdown of this level targets 0.89953, with the possibility of a further drop towards the July 2014 low at 0.88600.

However, if the pair is able to bounce off this support and sentiment on the USD changes, we could see a push towards 0.91533, with 0.92264 (38.2% Fibonacci retracement from the swing high of 23 March to today’s low) and 0.94004 remaining upside targets. This can also be viewed as a bullish retracement, which sellers could decide to wait on before initiating further short positions on the rallies.

USDCHF Weekly Chart