The Royal Mail share price is down 0.31% this Tuesday as selling pressure continues to mount on the beleaguered stock. The decline in the stock follows the company’s admission that one in five first-class letters do not arrive at their destinations the next day. This further confirms the woes the company has had due to the COVID-19 pandemic.

The company admits that the COVID-19 pandemic has ‘materially impacted’ the performance and service standards of the company. Due to COVID-19 and the inability to replace sick workers with new ones, worker absences have led to months of mail delays. First-class letters are typically meant to reach their destinations the next day, Saturdays included.

The company’s service standards annual report indicates that 81.8% of first-class mails were being delivered the next day, which falls short of its target of 93%. This figure is an improvement of a pandemic low of 74.7%.

The decline in the Royal Mail share price mirrors the anger of the British public about the situation, considering the cost of stamps for the first-class mails rose from 10p to 95p. Royal Mail said the increase was necessary as inflationary pressures threatened its universal service obligation, including Saturday mailing services.

Royal Mail Share Price

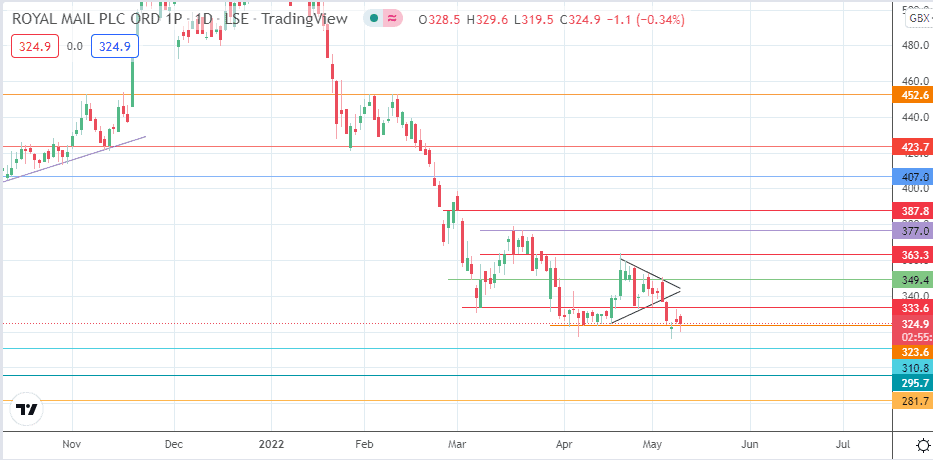

The symmetrical triangle breakdown on the daily chart has made the 323.6 support level vulnerable. A breakdown of this support allows for a price decline towards the 310.8 support level (1-18 December 2020 lows). Below this level, additional support comes in at 295.7 (23 November 2020 low) and at 281.7 (9 November 2020 high in role reversal).

On the other hand, a bounce on the 323.6 support allows for a push towards the 333.6 resistance (4 April and 10 May highs). Additional barriers to the north exist at the 349.4 price mark (5 May high) and at 363.3 (28 March and 21 April highs). The 21 March high at 377.0 and the 387.8 price resistance (1 March low) are also running as potential barriers to an advance if the price continues northwards above 363.3.

RMG: Daily Chart

Follow Eno on Twitter.