The Royal Mail share price has staged a recovery this Friday and is off 18-month lows after notching gains of 4.63%. However, this does not cancel out the steep drop of Thursday, which saw the stock close 12.38% lower after dismal full-year results.

The management of Royal Mail is trying to push back from the disappointing financials, blaming the company’s earnings shortfall and pessimistic forward guidance on a union dispute.

The Royal Mail share price has seen a steady drop in recent months as a protracted dispute with the Communication Workers Union (CWU) drags on. Royal Mail had offered a pay rise of 2% over the next two years, which the union rejected.

The sentiment around the Royal Mail share price remains shaky as the company said it would only meet its projected UK adjusted profit target of 303 million pounds if it strikes a deal with the CWU that averts a strike.

JP Morgan’s analysts are not optimistic that negotiations will be hitch-free and therefore expect material downside risks to any forward estimates. This is a situation which could put the Royal Mail share price under pressure for some time to come.

Royal Mail Share Price Outlook

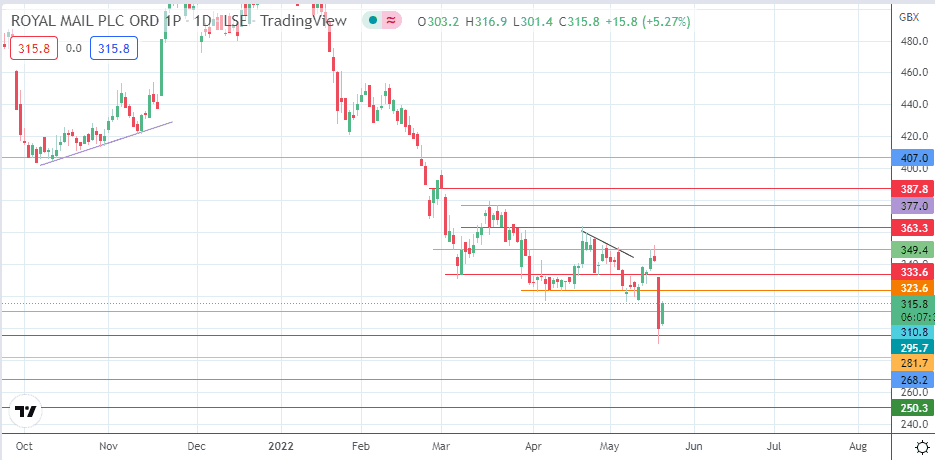

The recovery move comes off a bounce on the 295.7 support level. This uptick has violated the 310.8 resistance. It needs a 3% penetration close above this level to confirm the break, which gives access to the 323.6 barrier as the next target. Above this level, additional targets to the north are seen at 333.6 (8 March low) and also at 349.4 (4 March low and 17 May high). The 363.3 resistance (14 March and 21 April highs) is a target that requires a break of 349.4 to become a viable target.

On the other hand, if the intraday violation of 310.8 is not converted into a break by confirmation of the price/time filters, a retest of 295.7 will be on the cards. If the bulls fail to protect this price support, we could see a further leg down towards 281.7 (13 November 2020 high in role reversal). 268.2 (17 November 2020 low) and 250.3 may become new harvest points for the bears if the price deteriorates further.

RMG: Daily Chart