The Rivian share price is headed towards a higher open, as it currently trades at 39 cents above Tuesday’s closing price in pre-market trading. There has been a gradual increase in bullish Rivian stock price forecasts following the stock’s gradual recovery from its 11 May record lows. A lift in sentiment on EV stocks allowed for a broad-based market recovery among EV stocks.

The recent optimism around the stock comes from several factors. One of these is the optimism the company exuded about its production targets during the company’s earnings call earlier in May. The company is also in the middle of a restructuring, which has seen the entrance of a new Chief Operations Officer in Frank Klein.

The company is also splitting its commercial business from its retail business, keeping its Amazon delivery van manufacturing unit as a standalone business. New COO Klein brings 25 years of experience spent in Daimler, where he went from plant manager to the operational head of the Mercedes Vans division.

Analysts expect the company to overcome the recent car seat pricing dispute to produce 8,000 Amazon delivery vans. The Rivian stock price forecast from institutional analysts over 12 months comes with a median price of $51.46. This allows for a 65.98% upside potential.

Rivian Share Price Outlook

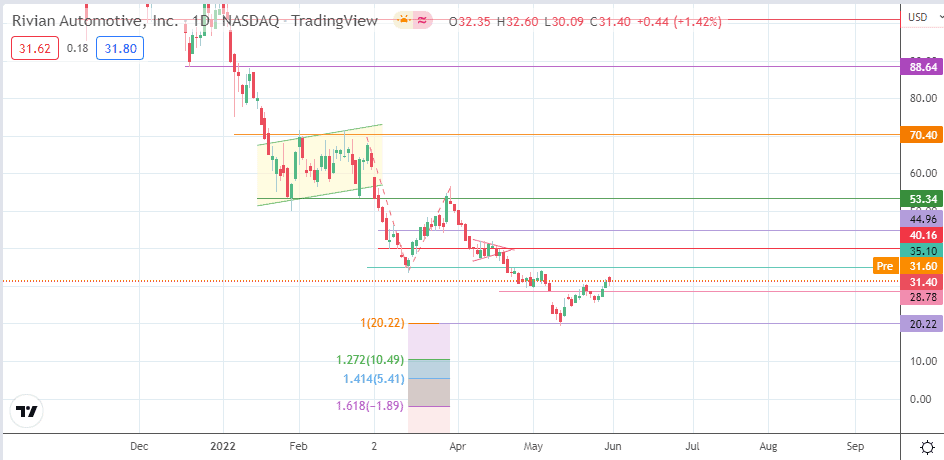

The break of the 28.78 resistance level has opened the door for an advance towards 35.10 (15 March low and 25 April high). Above this level, additional resistance targets will come in at 40.16 (8 March low and 18 April high), followed by 44.96 (8 March high and 24 March low) and 53.34, where the price low of 24 February is found.

On the flip side, a more extensive decline that follows the day’s intraday drop targets the support at 28.78. A decline below this pivot must also take out the low of 24 May before 20.22 (11 May low) becomes accessible to the bears. Additional southbound targets in record low territory are seen at the 10.49 (127.2% Fibonacci extension) and 5.41 (141.4% Fibo extension) price levels.

RIVN: Daily Chart