- Future Rivian stock price forecasts will depend on whether the bulls can extend the bounce on the daily chart.

The Rivian stock price is trading higher in premarket trading, pointing towards a higher open when the New York Stock Exchange opens for trading on Tuesday. On Monday, the Rivian stock price gained 1.8%, snapping an 8-day losing streak and deferring any other Rivian stock price predictions.

Rivian had resumed the slide on 30 March, as the markets reacted to its 10-K SEC filing released on 31 March, which pointed out rising industrial metal prices and supply chain disruptions as headwinds to its business. The report specifically said that “sizeable increases” in the prices of lithium, nickel, and cobalt, all components of electric vehicles, have impacted its business and operations.

Rivian Automotive Inc has also fixed 11 May as the date for its earnings call and release of its quarterly results. The Q1 2022 results will be announced in the market after hours. The report may provide more insight into how much the high cost of industrial metals will impact its business and whether there will be any impact on its existing forward guidance.

Rivian Stock Price Prediction

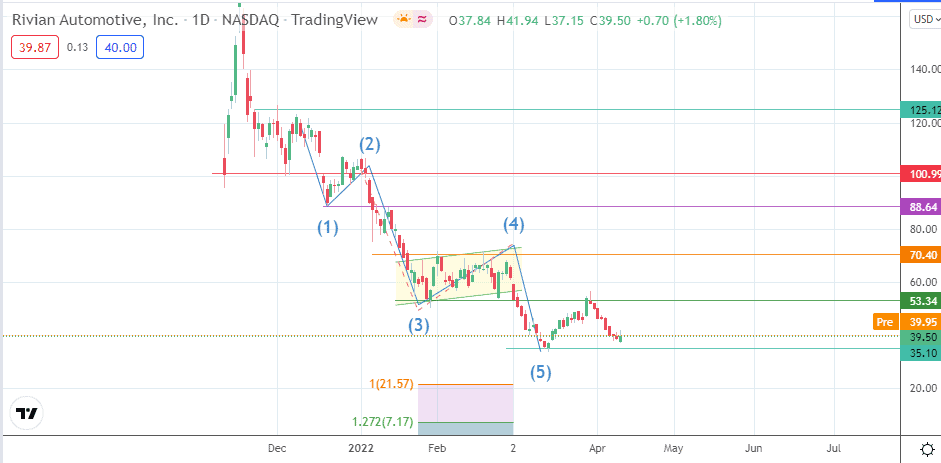

The completion of the 5th impulse wave to the downside marks the end of the measured move from the bearish flag seen on the daily chart. The bounce seen on Monday requires follow-through action from the bulls to send the price action towards the 53.34 resistance.

If this move plays out, additional momentum would be needed to take out the barrier at 53.34, targeting the 70.40 resistance (1/17 February highs). A march towards 88.64 (12 January high) looks assured if the bulls take out the 70.40 barrier. This move would complete the “c” wave component.

Conversely, a breakdown of the trough of the 5th impulse wave at the 35.10 support level opens the door for additional Rivian stock price predictions, as the new lows would track towards the 100% Fibonacci extension of the price swing from 4 January to 27 January at 21.57. Below this level, the 127.2% Fibonacci extension comes in at 7.17.

Rivian: Daily Chart

Follow Eno on Twitter.