Stablecoin Tether has recently come under intense scrutiny in the press, raising serious questions over its one-for-one Dollar backing. A recent Bloomberg article asking if ‘Anyone has seen “ Tether’s billions?” reignited a long-standing argument amongst cryptocurrency investors whether the stablecoin is fully collateralized.

What is Tether?

Stablecoins are cryptocurrencies backed by FIAT currencies to maintain a stable price. Tether (USDT) is the largest stablecoin and currently the fifth-largest cryptocurrency, valued at around $70billion. Stablecoins offer traders an efficient way to switch between different cryptocurrencies and exchanges and account for most Bitcoin trading. When Tether launched in 2014, the company claimed that each Tether was backed 1:1 with US Dollars. However, regulators discovered over $700m was moved from Tether Limited’s cash reserves to plug an $850 million hole at the associated Bitfinex exchange, leaving USDT seriously undercapitalized.

CFTC Fine

On Friday, the Commodity Futures Trading Commission (CFTC) issued Tether Limited a $41 million fine relating to “untrue or misleading” claims that the US Dollar fully backed USDT.

“Tether held sufficient fiat reserves in its accounts to back USDT tether tokens in circulation for only 27.6% of the days in a 26-month sample time period from 2016 through 2018” In response, the stablecoin issuer said: “These issues were fully resolved when the terms of service were updated in February 2019.”

Change in Terms of Service

In 2019, Tether Limited changed its terms of service and longer claimed to hold $1 for every USDT in circulation:

“Every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities.”

Furthermore, the terms and conditions provide no legal guarantees that Tether Limited will convert USDT to dollars.

How Much Cash is Tether Holding?

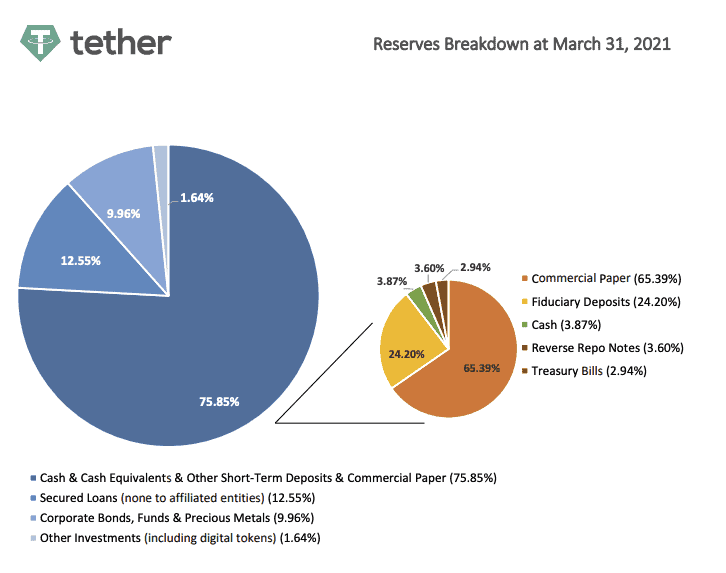

In March, Tether Limited published a vague breakdown of its collateral holdings, which shows most of its assets are Commercial paper and Fiduciary deposits, and holds just 3.87% in cash.

Is Tether Backed by Crypto?

A Financial Times report published this morning reveals that volatile cryptocurrencies may back some of the secured loans made by Tether. One of Tethers customers, Decentralized Finance Platform Celsius Network, told the paper:

“if you give them enough collateral, liquid collateral, Bitcoin, Ethereum and so on . . . they will mint tether against it.”

Celsius Network CEO Alex Mashinsky told the FT that the issued Tether is destroyed once the loan is closed out “so it does not permanently increase USDT in circulation”.

Mahshinsky explained that depending on market volatility, the loans are often over collateralized by 30%. Nonetheless, it raises questions over the type of loans Tether Limited is making.

Is Tether Safe?

Despite the ongoing debate, USDT is doing its job and holding its 1:1 dollar peg for now. Furthermore, Tether’s market cap shows no weakness, suggesting that institutions are still happy to use it. However, as the saying goes ‘there is no smoke without fire”. On that basis, until Tether Limited provides the market with some clarity, questions will remain.

For more market insights, follow Elliott on Twitter.