- The Nikkei 225, DAX indx, CAC 40, and other global indices rose today on stimulus hopes from the new US president, Joe Biden

The Nikkei 225 index is soaring today as part of the overall rally of global stocks. The index is trading at ¥28,756, which is a few points below the year-to-date high of ¥29.025. Similarly, other global indices like the Dow Jones, DAX index, Hang Seng, and FTSE 100 are pointing higher.

What’s happening: The Nikkei 225 index is rising as investors increase their expectations for a new large stimulus package in the United States. With economic numbers from the country disappointing, the new administration will be under pressure to deliver a bigger package as Yellen proposed. This will be a good thing for companies in the Nikkei 225 that do a lot of business in the country.

The Nikkei index is also rising after the Bank of Japan delivered its interest rate decision today. The bank left interest rates and other policy frameworks unchanged. They also lowered the outlook for the year because of the ongoing state of emergency.

Top movers in the Nikkei 225: The best performers in the Nikkei are Dentsu, Panasonic, Mitsubishi, and Olympus. Among the big caps, Softbank shares have jumped by more than 3% while Mitsubishi Motors have risen by more than 2.8%. On the other hand, the top laggards in the index are Hitachi, Kawasaki Heavy Industries, and Nikon.

Elsewhere: Meanwhile, the price of cryptocurrencies like Bitcoin, Ethereum, and Ripple is falling today as investors take profits. In commodities, the price of crude oil has fallen today after the surprise API reading. In Europe, futures linked to the FTSE 100, CAC 40, and DAX index are pointing upwards.

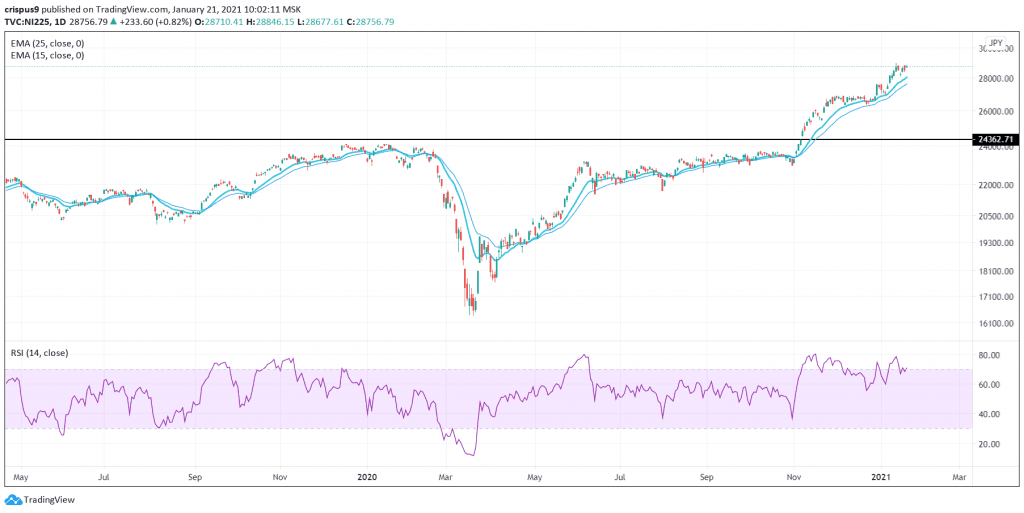

Nikkei 225 technical outlook

The daily chart shows that the Nikkei index has been on a strong upward trend and is now trading close to the 31-year high. The index is above the 25-day and 50-day exponential moving averages while the RSI is hovering along the overbought level of 70. Therefore, the index will possibly continue rising as bulls target the next resistance at 30,000Y.