- Ocado's share price has traded aggressively downwards in the past three trading sessions. The move started on Tuesday.

Ocado’s share price has traded aggressively downwards in the past three trading sessions. The move, which started on Tuesday, when it closed the markets with a 1.38 price drop, saw the trend continue into Wednesday, with a percentage point drop, and in yesterday’s trading session, when Ocado dropped, closed the markets with a drop of 2.26 per cent.

However, in the early hours of today’s trading session, Ocado’s share price started strongly and, at one point, had risen by more than a percentage point. Unfortunately, the strong and aggressive push to the upside at press time looks to have slowed, and prices have dropped below a percentage point gain. The trend is also looking to be mainly to the downside, and there is a high likelihood that we may see prices continuing with the bearish trend that started this week.

Ocado Share Price Analysis

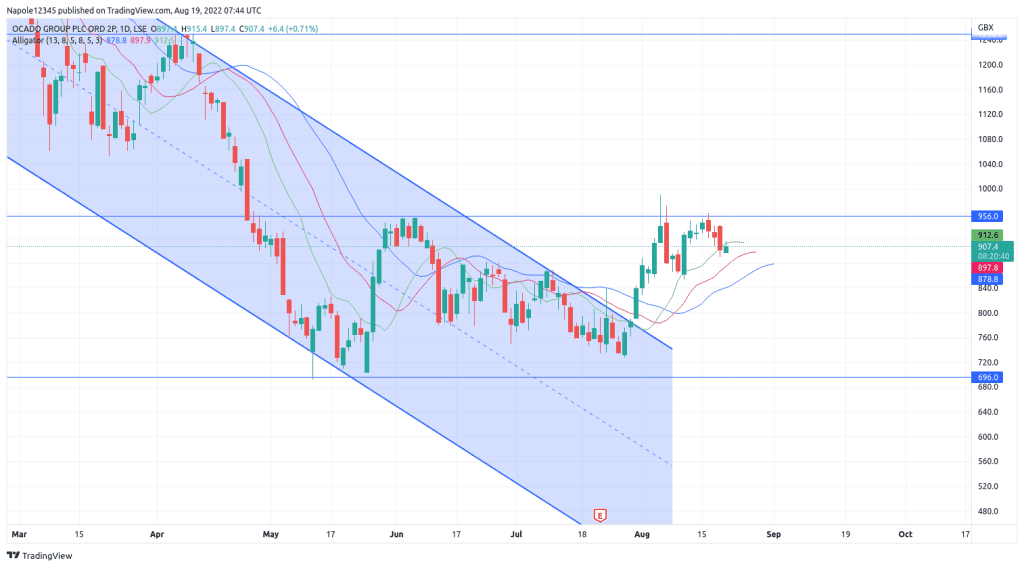

Looking at the chart below, there are a few things that are evident at first glance, including the prices recently hit the 956p supply level and failed to break to the upside. The result has been days of sideways trading as prices tried to break to the upside to no avail. However, the sideways market changed on Tuesday when the current strong and aggressive to the downside started, and since then, prices have looked bearish.

The second thing you notice on the chart is prices trading below the lips of the Williams Alligator indicator( the green line). Typically, when prices fall below the line, it is an indicator that, despite the trend is bullish, there is a high likelihood that we may be seeing a start of a new move to the downside.

Today’s price action is another technical indicator of where prices may move next. Despite Ocado’s share price starting strongly and rising by 1.5 per cent in the early hours of the trading session, the prices have dropped below 0.5 per cent gains at press time. Moreover, the intraday trading is also looking aggressively bearish, an indicator that we might see the company closing the markets with a price loss.

Therefore, in the next few trading sessions, I expect the Ocado share price to continue falling. As a result, we are highly likely to see prices trading below the 850p price level. However, a trade above the 956 price level will invalidate my bearish analysis.

Ocado Daily Chart