- The NZD/USD forecast ahead of the interest rate decision by the Reserve Bank of New Zealand (RBNZ) is presented here.

The NZD/USD will be in focus in the early hours of Wednesday, 17 August, when the Reserve Bank of New Zealand releases its interest rate decision. The expectation of the markets is for the bank to raise interest rates by 50 bps, taking the rates to 3.00%.

New Zealand is contending with intense internal inflationary pressure. The RBNZ had in its July rate statement shown a path to further hikes after it signalled it would keep raising rates “at pace.” What does this mean?

The RBNZ has already performed three prior rate increases by 50 basis points each. The markets expect the apex bank to continue with this pace of increase, which is why the consensus is as stated. The RBNZ also said in its last statement that it was comfortable with the projections it made in May about the pace of its rate hikes. So there is no reason to expect anything different this time around.

So far, the impact of the rate hikes seem to be working as recent data show that demand is cooling, especially in the housing market. Home prices are down 8%, according to the latest REINZ housing index data. Apart from the pandemic-induced drop in home sales, this metric is now at 11-year lows.

The market has largely priced in this rate increase. This will potentially lead to a slight near-term strengthening of the Kiwi Dollar, but this could give way to weightier fundamentals, especially with the latest bearish Chinese data piling pressure on commodity-linked currencies and the expected impact of the FOMC minutes, which will be released later in the day.

NZD/USD Forecast

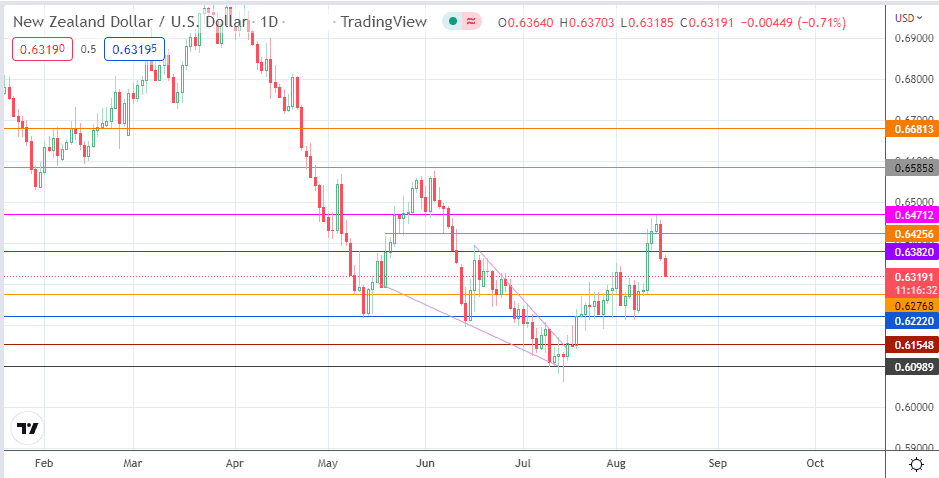

The two-day decline in the NZD/USD has truncated the breakout move from the falling wedge pattern. This decline has led to a breakdown of the 0.63820 support line, leaving 0.62768 as the initial downside target. If the decline continues below this pivot, 0.62220 (29 July and 5 August lows) becomes the next milestone in line. Additional targets to the south are at 0.61548 and 0.60989 (11 July low).

On the other hand, the bulls would be seeking a bounce on any of the listed pivots, ultimately targeting a break of the 3 May and 12 August highs at 0.64712. If this is achieved, the next target comes in at 0.65858. The 4 February high/22 February low at 0.66813 becomes the next upside target if the last barrier is broken.

NZD/USD: Daily Chart