The US Non-Farm Payrolls report for July was released roughly an hour ago, and the figures were largely disappointing. Not only was employment change exactly as analysts had predicted (+164K), the unemployment rate also rose to 3.7%, which was higher than what analysts had expected (3.6%). Furthermore, last month’s figures were revised downwards from +224,000 to +193,000.

Average monthly wage also grew to 0.3%, versus the 0.2% that analysts were expecting. The US Trade balance also came in worse-than-expected at -$55.2billion, against the -$54.2billion consensus number.

An analysis of the previous employment change numbers reveals the following:

- Over the last 6 months, there has been a decrease in employment change from 165,000 to 140,000.

- Over the last 12 months, the average employment change has basically remained flat at 187,000. The yearly average for 2018 was 220,000.

In other words, while hiring by US companies is still going on, the growth in employment has basically stalled. With fewer persons being taken into work positions, competition for suitable workers has increased and that has helped to drive wages higher, as shown by the increase in the average hourly earnings.

How did the USD Fare?

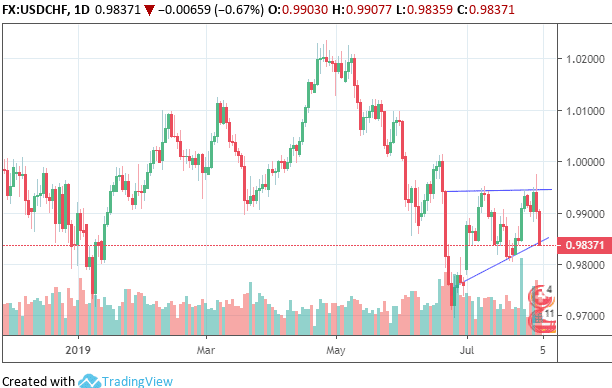

The response of most currency pairs featuring the USD was basically muted. However, the USD is under pressure in its pairing with the Swiss Franc, and this could be due to increased safe haven buying. The latest news on imposition of tariffs by the US on Chinese products is going to do little to end the US-China trade war. Traders may have to prepare for long-drawn battle between both countries before the knotty issues are resolved. The NFP and wage figures will add to the arsenal of those who think that further easing from the Fed in 2019 is a real possibility.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.