Nasdaq started higher today adding 0.16% at 8,115 as investors focus turn to central banks measures to support economic growth. Markets expect the ECB to cut interest rates by 20 bps on Thursday. The Nasdaq is 22.29% higher Year to date.

The Dow Jones Industrial Average is 0.31% higher at 26,879, while the S&P 500 trading 0.19% higher at 2,984.44. The CBOE Volatility Index (VIX) is adding 1.00% today at 15.15 to confirm a cautious market mood.

Nasdaq getting a boost from ACADIA +64.58%, Changyou +50.90%, Ardelyx +15.40 and Michael Cos. +14.50%. On the other hand Nasdaq dragged down by Modern Media -21.75 and Paysign -19.28.

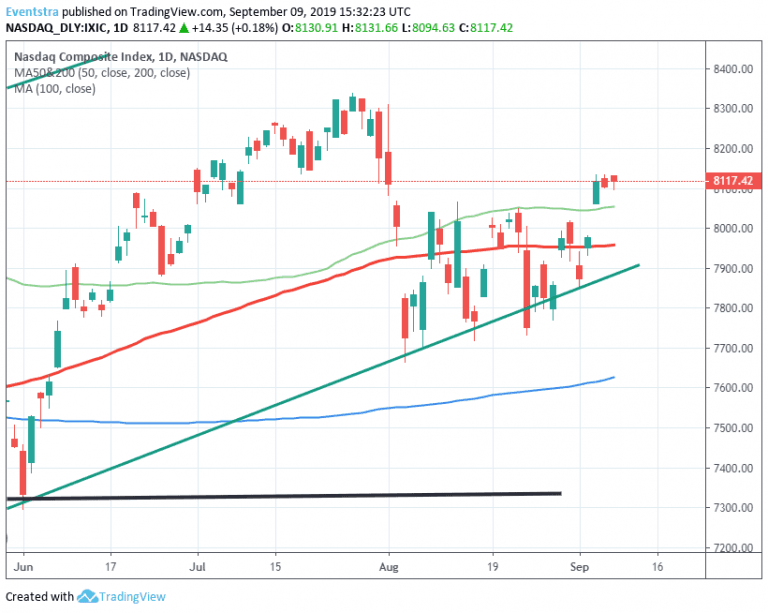

Nasdaq price continues to trade above the 100-day moving average and bulls are in control. On the upside immediate resistance stands at 8,131 the daily high and then at 8,310 the high from August 1st. On the downside immediate support stands at 8,094 today’s low, while more bids will emerge at 7,882 the low band of the ascending channel. Traders looking to enter long positions can buy if the index manages to close above today’s high, targeting a break above 8,300 mark for profits, and can keep their long positions as far the index is trading above the 8,000 mark. A short position might be initiated if the index breaks below the 100 day moving average at 7,957. The technical analysis suggests a near-term bullish outlook for Nasdaq.

The European Indices trading mixed, the FTSE 100 is 0.79 percent lower at 7,225 as the pound trades at 1.2353. DAX 30 is 0.20 percent higher at 12,216 while CAC 40 in Paris is 0.29 percent lower at 5,588.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.