- What is the Moderna stock price prediction? We explain why the stock has declined and whether it is a good investment today.

The Moderna stock price meltdown continued this week as investors remained concerned about the company’s growth. MRNA shares have dropped in the past six days and are hovering near the lowest level since May 2021.

Table of contents

The rise and fall of Moderna

Moderna has grown from a small and unknown company to one of the best-known globally. As a result, the company’s MRNA stock price jumped from a low of $11 in 2019 to almost $500 in 2021. Today, the stock is trading at $160, bringing its total market capitalization to about $64 billion.

There are several reasons why the Moderna share price has collapsed even as millions of people continue receiving its vaccines and boosters.

First, investors are broadly worried about the company’s growth, considering that the number of people being vaccinated is slowing down. In other words, the benefits that Moderna is expected to generate from the vaccination process have already been priced in.

Second, there are concerns about the ongoing controversy between Moderna and the National Institute of Health (NIH). The institute wants to be recognized as a co-inventor of Moderna’s vaccine. If a court determines that, there is a risk that it will say that it has a right to provide the patents to other companies.

Finally, the decline of Moderna is partly because of the overall underwhelming performance of the biotech sector. Recent data suggests that most biotech stocks have declined sharply lately. For example, the VanEck Biotech ETF has declined by almost 26% from its 2021 high, as shown below.

Moderna pipeline

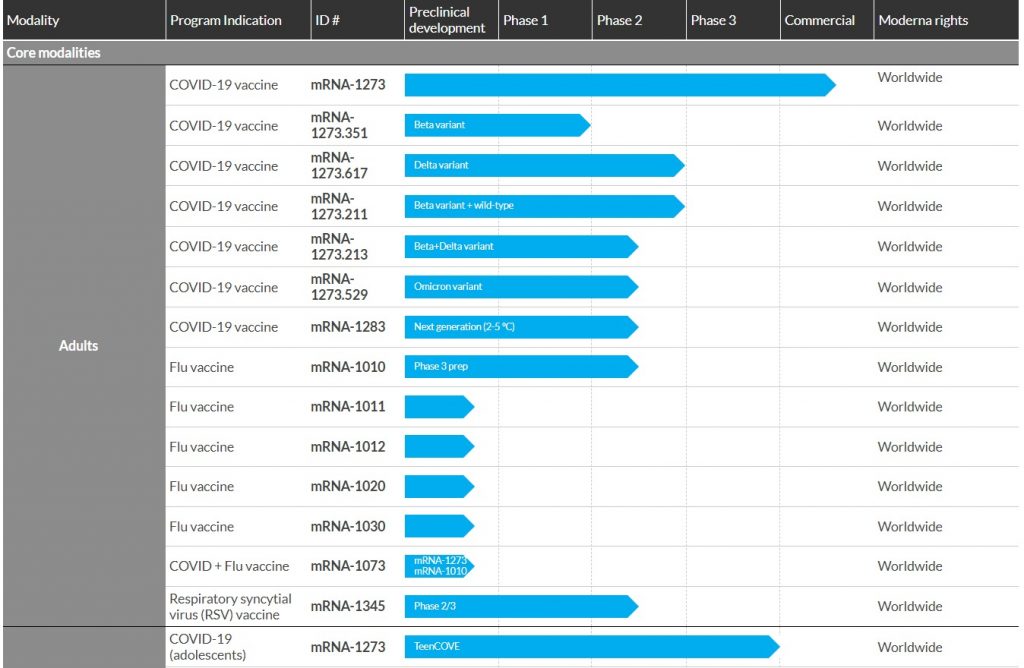

Another reason why the Moderna stock price has declined is that investors are concerned about the company’s pipeline. A pipeline is the number of vaccines or drugs in various phases of their development.

As you can see on this page, the most important vaccines in Moderna’s pipeline are all related to Covid-19.

Other vaccines with a long way to go are the flu and HIV vaccines. The company is also researching vaccines on cancer, localized regenerative therapeutics, and systemic intracellular therapeutics, among others.

Is Moderna a good investment?

So, the most common question among investors is whether Moderna is a good investment after its stock crashed by more than 60% from its all-time high.

There are several reasons to believe that the MRNA stock price will do well in the future. But there are other concerns that the company is a risky one.

First, the company has a leading role in fighting Covid-19 and the new variants such as Delta and Omicron. The name recognition will make Moderna a respected company that will be called upon when future infections come.

Second, the windfall from the Covid pandemic will help the company boost its research for other rare and common diseases. In the past quarterly results, Moderna said that it’s cash and short-term investments were worth over $15 billion. The company had just $1 billion in the same quarter in 2016.

Third, Moderna has a clean balance sheet. It has over $20 billion in assets and about $10 billion in liabilities. It will use its Covid manufacturing plants when it starts to manufacture other vaccines.

Fourth, and most importantly, Moderna is developing vaccines for large industries. For example, the flu vaccine industry is estimated to grow from $6.5 billion in 2022 to more than $10 billion in 2028. Therefore, Moderna will likely use its network to gain market share in the industry if the vaccine is approved.

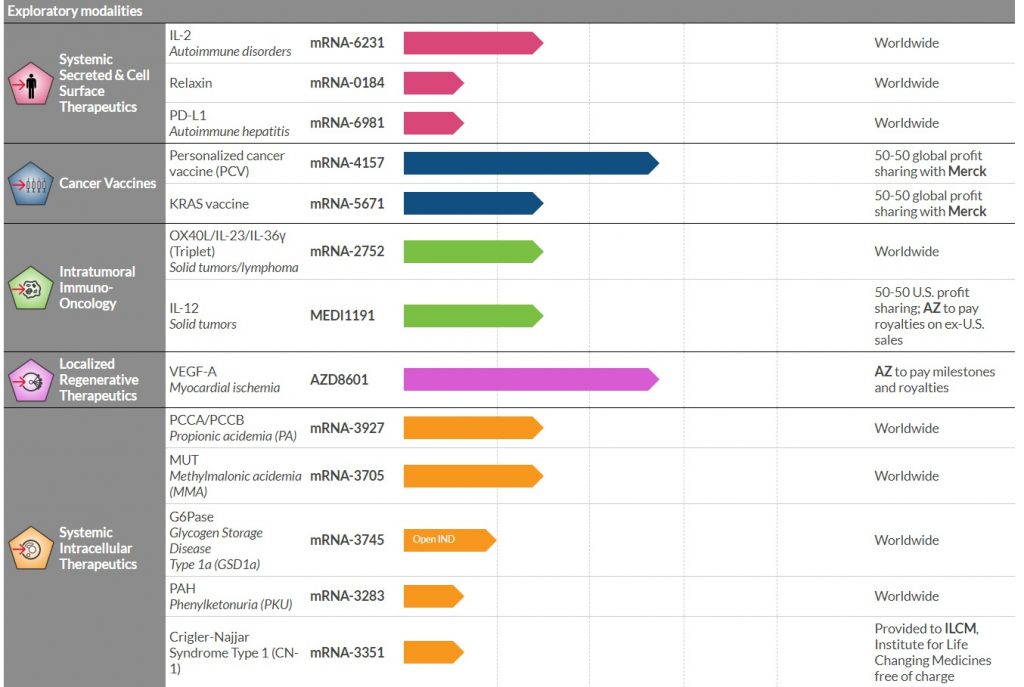

The same is true with cancer. In the past few years, cancer has become one of the biggest killers in the world. Therefore, if it can get its cancer vaccine right, it will be another windfall for the company. The chart below shows Moderna’s exploratory drugs.

Is Moderna overvalued or undervalued?

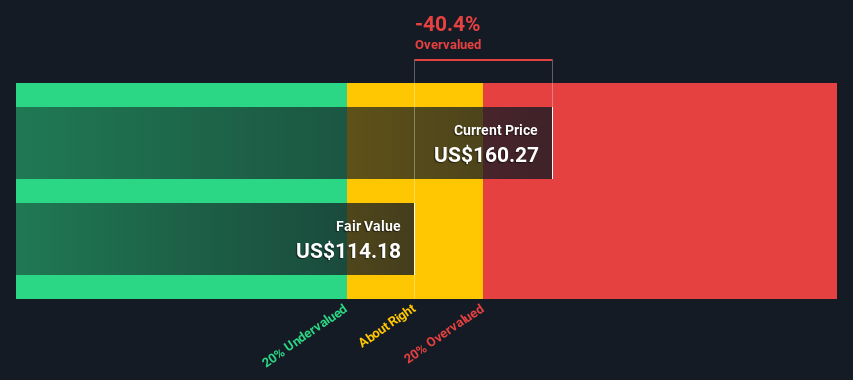

So, the most important question that people ask before they invest in a stock is whether it is overvalued or not. So, is the Moderna stock price overvalued?

There are various approaches to answering that question. First, let us look at the multiples the stock is trading at. Data compiled by SeekingAlpha shows that Moderna is trading at a trailing PE ratio of 9.77. In contrast, other biotech companies like Gilead Sciences, Vertex, and Biogen have a PE ratio of above 12. The US stock market has a PE of 16x.

This means that the Moderna stock is undervalued when using this metric. The undervaluation is primarily because of the company’s narrow offering.

Another way is to use a discounted cash flow (DCF) to estimate the value of the company’s cash flows. While this is a good model, it is difficult to use for Moderna because it is hard to estimate its future cash flow when demand for its Covid vaccine wanes.

According to Simply Wall Street, the DCF valuation of Moderna’s stock is at $114. This means that the stock is overvalued by about 40%.

Moderna stock price forecast 2022

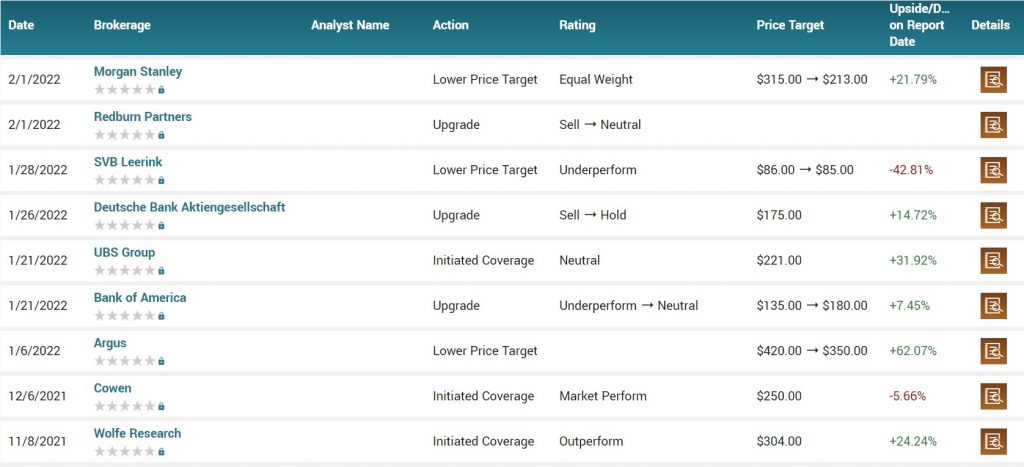

Analysts are generally optimistic about the MRNA share price. According to Marketbeat, analysts have an average target of $245 for the stock. That price is about 53% above the current level. The most optimistic analysts are from companies like Morgan Stanley, Bank of America, and Argus. On the other hand, Redburn Partners and Deutsche Bank analysts have a pessimistic view of the Moderna stock price forecast.

Moderna technical analysis

To predict where the stock will end the year, we will look at the weekly chart. On the chart, we see that the stock has been in a bearish trend lately. Along the way, it has moved below the 61.8% Fibonacci retracement level. That is a sign that the stock will likely keep falling in the first part of the year.

At the same time, we see that the pair is now forming the corrective Elliot wave. While the decline will likely continue, the stock will likely bounce back later this year and retest the all-time high of over $450. Of course, this view will be invalidated if the stock falls below $100. If that happens, it will signal that there are enough bears in the market.

Why is Moderna tanking?

As we wrote above, the Moderna stock price forecast is tanking as investors look into the company’s future. They expect that the firm’s business will slow as the hype of vaccinations wane. Worse, the company’s pipeline is still a long way to go to generate returns. The company will provide an update about these issues when it publishes its results on February 24th.

Summary: Should you buy Moderna?

Moderna has grown from a small company with no major product to a world leader in Covid vaccines. However, its hype has eased, pushing its stock from almost $500 to $160. Therefore, as mentioned, there is a likelihood that the stock will continue falling for a while and then bounce back in the coming months.