- The Nikkei 225, Hang Seng Index, and USDJPY finish 2019 in the red. On the other hand, AUDUSD tapped new 3-month highs in today's Asian session.

Santa Claus Rally Finished on Nikkei 225 and Hang Seng Index

The Nikkei 225 extended its losses today when it closed 181.1 points or 0.76% lower at 23,656.6. Meanwhile, the Hang Seng index is currently down 129.6 points or 0.46% at 28,189.8.

On the other hand, AUDUSD is up 14 pips from its opening price at 0.7006, which is also the currency pair’s new five-month highs. Meanwhile, NZDUSD is unchanged at 0.6724. USDJPY is down 20 pips from its opening price as it currently trades at 108.65.

Chinese PMIs Print Mixed Figures

Earlier today’s China’s manufacturing PMI for December topped forecasts when it printed at 50.2 versus the forecast which was at 50.1. On the other hand, the non-manufacturing PMI was lower than what analysts had expected at 53.5 compared to the 54.2 consensus.

Trade One Deal to be Signed Soon?

Earlier this morning there was also news that a Chinese delegation is getting ready to fly to Washington. After months of negotiations, rumors are that the US and China are going to sign their phase one deal this weekend.

Now while these news should have been bullish for equities markets and risk currencies, it would seem that investors are more focused on re-balancing their portfolios ahead of the New Year.

Read our Best Trading Ideas for 2020.

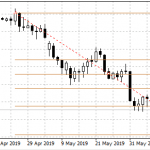

USDJPY Outlook

On the daily time frame, we can see that resistance around 109.65 held. USDJPY has now found its way to support at the rising trend line at 108.60 when you connect the lows of November 1 and December 12. This price also coincides with the 200 SMA. Now, if sellers continue to dominate today’s trading, a bearish close below the trend line could mean that USDJPY will be headed to support around its November lows at the 108.00 psychological handle.

On the other hand, a reversal candle at the trend line could mean that buyers are priming for another test of 109.65.