- It's been a quiet start to what could be a volatile Tuesday. Asian stocks have recouped some of their losses and the dollar has a mixed performance.

The pound was the best performer in the Asian session as it held on to its against the US dollar from yesterday’s news. Meanwhile, the Aussie recouped some of its losses on positive domestic news. On the other hand, the Kiwi and Japanese yen were weakest against the US dollar on the back of lower inflation expectations and remarks from Japanese Prime Minister Shinzo Abe.

It’s been a relatively quiet session to start off Tuesday’s trading. Asian equities markets cautiously recouped their losses with the Nikkei up 0.81% at 23,520 and Hang Seng Index up 0.43% to 27,042.5.

Today’s sigh of relief from equities comes after news of mounting tension in Hong Kong sparked risk aversion on Monday. There was also news from Japan that Prime Minister Shinzo Abe called for higher budgets to support the economy. This means that policymakers are now looking at fiscal policies to support economic growth instead of just relying on further loosening monetary policy. The news sparked a bit of risk appetite and ushered flows into equities and out of the safe havens like the yen.

Economic Reports from Australia and New Zealand

On the economic calendar, only NAB Business Confidence and Inflation Expectations reports were released from Australia and New Zealand, respectively. The business survey came in at 2 which suggests that business conditions have improved in October after coming in flat in September. On the other hand, two-year inflation expectations in New Zealand printed lower at 1.80% from initially being estimated at 1.86%. Consequently, the news helped AUDUSD recover from its Asian session lows at 0.6830 to trade above its daily open. Meanwhile, NZDUSD dropped to its 3-week lows as softer inflation supports speculations that the RBNZ would cut rates tomorrow.

ZEW, UK Employment Data, Trump Speech Due Later

Looking ahead, there are a few reports from Europe.

The UK will be releasing their employment data at 9:30 am GMTfor October with claimant count change eyed at 24,200 and unemployment rate at 3.9%.

At 10:00 am GMT, Germany’s ZEW Economic Sentiment Index is expected to show that Germans have grown less pessimistic about economic conditions this month. It is eyed to come in at -13.2 from -22.8 last month. Meanwhile, the euro zone-wide ZEW economic index is anticipated to print at -11.5 from -23.5 in October.

Later this afternoon, US President Donald Trump will be making a speech in the Economic Club of New York at 5:00 pm GMT.

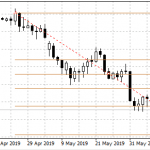

USDJPY Technical Outlook

On the 15-minute chart of USDJPY, we can see that the currency pair has completed a bullish flag pattern earlier today and rallied beyond yesterday’s high to 109.28. As of this writing, it looks like it could be forming another bullish flag. If there are enough dollar bulls in the market today, we could see USDJPY rally to last week’s high at 109.47. Alternatively, a stronger yen could send the currency back down to test support at the rising trend line (connecting the lows of November 11 and November 12).Download our latest quarterly market outlook for our longer-term trade ideas.