- Asian stocks finished higher on Monday as more countries reopen businesses and investors bet on fast global recovery. Wall Street ended higher on Friday

Asian stocks finished higher on Monday as more countries reopen businesses and investors bet on the fast global recovery. Wall Street ended higher on Friday despite the unemployment rate rose from 4.4% to 14.7% while more than 20 million Americans lost their jobs in April.

Sentiment also boosted by an improvement in US-China trade tensions after trade representatives from China and the US held a phone call aimed at reducing tensions while agreed to strengthen the economic and health cooperation.

Ifo institute reported that 39% of German companies in the car industry decided to cut jobs in April, while 50% of companies in hotels, 58% in restaurants business, 43% in travel agencies also decided to cut jobs last month. The Robert Koch Institute reported 169,575 confirmed coronavirus cases with a total of 7,417 deaths.

Nikkei 225 finished 1.05% higher at 20,390. The Hang Seng Index is 1.44% higher at 24,581. The Shanghai Composite index is 0.21% lower at 2,889. The FTSE Straits Times index in Singapore is 0.32% higher at 2,600. The Aussie ASX 200 index is 1.13% higher at 5,452.

Download our Q2 Market Global Market Outlook

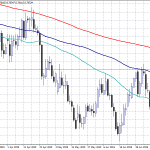

AUDUSD Testing The 100-Day Moving Average

AUDUSD started higher on Monday as the rally continues for the third consecutive day. The pair trades at monthly highs while as of writing it tests the 100-day moving average which if breached will cancel the bearish momentum. Last week the pair rejected at the 100-day moving average.

On the upside, the first resistance for AUDUSD stands at 0.6561 the daily high. Above the 0.6561 the next target will be at 0.6620 the high from March 10. Next supply zone would emerge at 0.6671 the 200-day moving average.

On the flip side, immediate support for AUDUSD stands at 0.6514 the daily low. Next support will be met at 0.63676 the low from May’s 7 trading session. A break below might test the 50-day moving average at 0.6286.