- Is Rivian a good investment? Our analysis explains it using long-term forecasts for the next 10 years, check Rivian stock price prediction.

Rivian Automotive (NASDAQ: RIVN) has had a good run in 2025, gaining about 10% yeat-to-date and its stock price has stayed on the ascending trajectory since August. This rise by the EV maker is contrasts greatly from the problems the company had in the past, and it shows that investor sentiment is shifting positively. However, investors also want to know if the stock can maintain its current upward trajectory or if it’s just a bubble.

Although there were delays and problems with the supply chain, Rivian was able to demonstrate that it could increase production at its plant in Normal, Illinois. The company has also revealed production and delivery numbers that are better than expected, which gives investors confidence that it is making progress toward its ambitious manufacturing goals.

Rivian-Volkswagen Joint Venture

The VW deal, which will be inform of a joint venture (JV), will see Volkswagen invest $5 billion in the EV company in phases up to 2026. In exchange, the German auto giant will access Rivian’s IP software, electrical infrastructure expertise. In addition, the two companies will work together on upbeat confidence among investors, much as skepticism remains over the company’s fundamentals.

The Volkswagen JV will see Rivian receive $ billion initially in form of an unsecured loan convertible into stock. $ 2 billion will be in form of cash and loans, and two-$1 billion investments will be advanced to Rivian in 2025 and 2026.

Also, over 70,000 units are still pending with Amazon (AMZN) for delivery of commercial vans, so there’s some revenue security there as well. Amidst all these, the revival of construction on the Georgia factory, which is expected to produce 400,000 vehicles a year by 2028, shows how scalable the project is.

What is Rivian?

Rivian is an American electric vehicle and adventure travel firm that designs and produces electric cars. It was Founded in 2009 and is located in Plymouth, Michigan. The company has attracted substantial investment from Amazon and Ford, among others, and aims to become a leader in sustainable transportation.

The production of its initial offerings, the Rivian R1T truck, and the Rivian R1S SUV, started in late 2021. In the long run, Rivian intends to provide mobile adventure gear and expand to a global market.

Rivian is also gearing up to enter the mass market. Consumers are excited about the R2 SUV coming out in early 2026, with a starting price of $45,000. Already there are hundreds of thousands of pre-orders and the per vehicle margin is expected to be positive from day one.

Next will come the R3 and R3X models, which are directed at Europe and the mainstream market. CEO RJ Scaringe has said that Rivian might have hands-free, point-to-point autonomy by 2026, thanks to high-res cameras and neural nets. This makes Rivian a viable competitor to Tesla in AI-driven mobility.

Rivian Stock Symbol

Rivian trades on the Nasdaq under the ticker RIVN, the same symbol it received during its high-profile IPO in November 2021. The company went public at 78 dollars per share, debuting with a valuation of roughly 66.5 billion dollars after becoming the first automaker to deliver an all-electric pickup truck, the R1T.

As of early December 2025, Rivian’s market value has reset to about 22 billion dollars, with the stock trading close to 18 dollars, reflecting a changed macro backdrop and the capital-intensive nature of scaling EV production.

Rivian Stock Fidelity

In July 2021, Rivian closed its private funding round with a $2.5 billion investment. This round was led by corporate giants like Amazon, Ford, and D1 Capital Partners. Other participants included Fidelity Management & Research Company, along with a few other capital management firms.

Rivian Latest news

Following its recent upsurge, analysts have been revising their price targets for Rivian stock. The latest such revision is by BNP Paribas analyst, James Picariello, who raised the target from $18 to $20, with an “Overweight” rating. That infers an 18% upside from the current price, signaling a strong growth potential.

Earlier in May, the company adjusted downwards its delivery guidance for 2025, from 46,000-51,000 units to 40,000 to 46,000 units. In addition, it raised its capital expenditure forecasts from $1.6 billion -$1.7 billion to between $1.8 billion and $1.9 billion.

Rivian attributes the move to the impact of trade tariffs imposed by the Trump administration. While the company manufactures the vast majority of its vehicle components in its Illinois plant, it says it is not immune to the effects of the tariffs on the broader economy. It imports parts like lithium ion batteries from South Korea and China.

However, Rivian also attributed its strong show to the sale of automotive regulatory credits worth $157 million. While the company has been struggling to return profits, its recent earning trends signal significant improvement, which augurs well for Rivian stock price outlook.

Rivian Deliveries

Rivian’s Q2 2025 earnings, which came out on August 5, were better than expected. The company had $1.30 billion in revenue, beating the $1.28 billion forecast by analysts and a smaller gross loss of $206 million. Also, per-vehicle losses fell to $38,798, which means the company is saving money by retooling its Illinois facility and improving its supply chain.

Furthermore, deliveries stayed at about 13,000 vehicles, and the company kept its full-year forecast of 40,000 to 46,000 units, even though there were problems with the supply chain, such as a shortage of rare earth metals. With $7.5 billion in cash, free cash flow improved to -$400 million, giving the company a runway for several years.

Rivian E-bike Venture

Rivian entered the micromobility market in late March 2025, after spinning off its e-bike lab into a subsidiary called Also. The move was supported by a $105 million Series B investment by venture capital firm, Eclipse. Consequently, Rivian will start producing scooters and electric bikes.

That is a significant divergence from its heavy-duty R1S SUV and R1T truck, which for which it is known, and gives it access to the broader mass market. However, the business carries an underlying risk, going by the struggles experienced by major auto manufacturers like Jeep, GM, Hummer, Mercedes and Porsche.

Rivian’s 2 and R3 Models

Rivian’s poster vehicles, the R1T and R1S models, both typically cost more than $100,000. However, the company will introduce three new models R2,R3, R3X, all of which are expected to cost less than $50,000. That will expand the company’s market reach, substantially increasing its revenue base. The Normal plant is critical to Rivian’s growth plans, with its R2 and R3 models set to be produced at the plant ahead of delivery from 2026.

Rivian Stock Price Today

Rivian (RIVN) is trading near $17.61 as of the latest close on December 8, 2025, giving the EV maker a market capitalization of about $21.59 billion. The stock has climbed steadily over the past month, gaining more than 7 percent, and recently touched a fresh 52-week high of $18.60. Despite this recovery, Rivian still trades well below its IPO price of $78.

Short-term momentum remains constructive, with price action holding above recent support levels and intraday ranges staying tight. The broader sentiment around EV stocks and Rivian’s delivery trajectory will continue to shape the stock’s near-term direction.

Rivian Stock Price Prediction 2026

Rivian’s outlook for 2026 will depend heavily on its ability to scale production, strengthen margins, and convert rising demand for electric trucks into consistent profitability. Analysts tracking the EV sector expect Rivian to continue narrowing its losses through cost discipline and more efficient manufacturing, especially across its R1 lineup and commercial van program.

If delivery numbers accelerate through 2025 and supply-chain stability holds, several market forecasts place Rivian’s potential 2026 trading range between $22 and $30, supported by improving revenue visibility and stronger order flows. However, downside risks remain if macro conditions tighten, competition intensifies, or cash-burn pressures resurface, scenarios that could keep the stock closer to $15–$18.

This balanced outlook reflects both Rivian’s long-term growth potential and the reality that the EV market is still sensitive to interest rates, consumer demand, and capital-market sentiment.

In the meantime, I’ll keep sharing updated Rivian stock price forecast and my personal trades on my Twitter where you are welcome to follow me.

The recent gains in Q3 2025 have been great, but a couple things make me think that the way forward won’t be easy. It is important that the R2 launch goes well. Also, Rivian needs to stick to its manufacturing schedule and save costs if it wants the car to be a success. Any problems or delays could make investors lose faith in the company.

Rivian is still losing money, even though it has achieved positive gross profit. That trend will likely continue for the foreseeable future. The current Rivian stock price is predicated on its potential for long-term growth, not its current profitability. This makes it sensitive to market fluctuations or any signals of weakness.

Rivian Stock Price Prediction 2030

Many analysts expect a new all-time high in US equities by 2030. Although the asset prices in 2030 could be anybody’s guess but considering the current growth of Rivian Automotaive, Inc. we can take a shot. If the company keeps adding new vehicle categories in its portfolio, then I expect the Rivian stock price to retest its IPO price of $78 before 2030. The optimal operation at the Normal plant and construction of the Georgia plant could help the company turn around its revenues and increase its capacity to take on competition from the likes of Tesla and Chinese EV models.

Rivian Stock Price Prediction 2040

A lot can happen in the world till 2040, therefore, it’s very difficult to predict RIVN stock price 16 years from now. Wars, famines, recessions, and hyperinflation are like slow poison for any business. If Rivian evades all of them and keeps growing then I expect it to give Tesla a tough time by 2040. Many people are already comparing Rivian R1T with Tesla cyber truck.

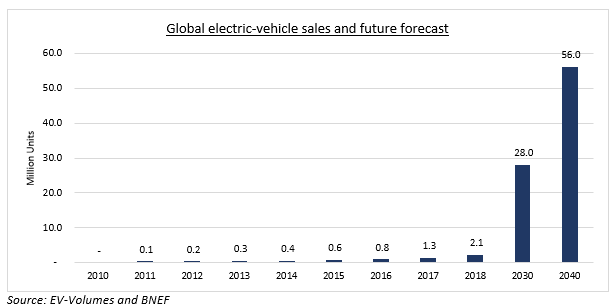

Also, despite its troubles in 2024, the global EV demand is projected to grow at a compound annual growth rate (CAGR) of 23.4% from 2024 to 2032. The transition from fossil fuel-run cars to EVs has gathered traction and the momentum will likely continue picking up as governments shifts towards the “green” agenda.

Is Rivian a good investment?

Rivian stock has already plunged 90% from its November 2021 peak of $179.47. It is highly unlikely that the price can have a similar downward rally in the near future. Therefore, I consider Rivian a good investment for at least a short term in anticipation of a relief rally. Furthermore, the company has proven its ability to match sales with steady revenue growth, much as it still spends a significant portion of its earnings on production. After producing 24,337 vehicles in 2022 it produced 57,232 units in 2023 with revenues hitting $4.43 billion.

Also, while the company has been hemorrhaging funds (it accumulated losses amounting to $5.43 billion in 2023), its growth strategy seems to be working, and could help it start generating profits.

Rivian’s market cap has declined by about 90 percent from a peak of just over $100 billion in 2021 to about $21.6 billion in December 2025. These figures are quite unimpressive and it doesn’t help that it finds itself extending its loss-making spree in an EV market whose level of competition is tightening by the day. With new entrants from China offering lower prices, Rivian, like other US EV makers, finds itself at a crossroads.

Specifically, the company may be forced to cut prices significantly to reach the mass market, while its production figure remain relatively low, below 60,000 units per year. Worse still, its less-expensive mass-market model, the R2 SUV, won’t be ready for delivery until the first half of 2026. The company also intends to expand to external markets, which could broaden its revenue stream.

One of its key strategies in its expansion plans is the sale of the new, smaller R2 model, which is expected to be cheaper at $45,000 per unit. Rivian reported that it received 68,000 reservations within 24 hours of R2 the announcement, and expects the demand to grow to as much as a million units per year across the world.

In a surprise announcement, Rivian CEO Robert Scaringe revealed that the company will add new models, the R3 and R3X to its production line. The two will cost between $37,000-$43,000 and are expected to attract more buyers, as the company focuses on giving customers more options.

How to buy Rivian stock?

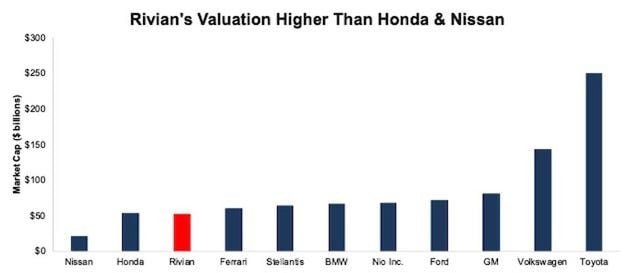

If you’re wondering how to buy Rivian stock, then you should know that it is listed on the Nasdaq stock exchange as RIVN. You can also invest in Rivian stock CFDs and derivatives on different platforms like eToro and Robinhood. The current price presents a good buying opportunity as Rivian was very overvalued at its IPO. Its IPO valuation made it even bigger than Honda and Nissan.

Should I buy Rivian stock?

If you believe in Rivian’s vision and consider its technology better than Tesla, then Rivian stock at its current price could be a nice buy. However, the stop loss must be kept under January 2023 low of $15.28.

How much is Rivian stock?

Rivian stock trades at $17.61 as of December 2025. After rallying for a long period, the US equities markets are flashing signs of a potential correction, and this could increase pressure on the economy. Coupled with higher-for-longer interest rates and high inflation, Rivian sales are likely to take a hit, and this will almost certainly affect the stock price. At its peak, the company was valued more than $100 billion, meaning that it has lost more than 80% of its value.

When can I buy Rivian stock?

With Tesla now valued at over $1.38 trillion, Rivian’s current market cap near $21–22 billion places it at a fraction of the size of the EV leader. This valuation gap is exactly why many investors view RIVN as a high-upside, limited-downside opportunity.

If Rivian successfully scales production and improves margins, even a modest re-rating toward peers could deliver substantial long-term gains. For that reason, buying Rivian stock at current levels offers an attractive risk-reward profile for investors comfortable with volatility.

What is Rivian stock trading time?

As mentioned earlier, Rivian stock trades on the NASDAQ stock exchange, which is the second largest exchange in the world. NASDAQ trading hours are 9:30 am to 4:00 pm Eastern Standard Time and no trades take place over the weekend. Rivian is listed on the exchange under the ticker symbol RIVN.

Rivian attracts interest because its valuation remains far below major EV peers while demand for its vehicles continues to rise. Investors watch production growth, cash burn, and upcoming models to gauge long-term upside.

Analysts expect Rivian to move closer to profitability as scale improves and operating costs drop, but consistent profits may not appear until after 2026. Many long-term forecasts focus on margin expansion and delivery growth through 2030.

Price expectations vary widely, but most projections link upside to Rivian’s ability to ramp production, reduce losses, and compete with Tesla and legacy automakers. Stronger demand or new partnerships could lift valuations significantly in a bull cycle.