- What is the outlook of the Lloyds share price after the sharp rebound? We explain why it is not in the clear yet.

The Lloyds share price has rebounded sharply in the past two days after crashing to the lowest point since March 2021 this week. The LLOY stock is trading at 45.38p, about 18% above the lowest point this week. In addition, other London bank stocks like HSBC, Barclays, and Standard Chartered have rebounded their share prices.

The UK has been at the forefront of implementing a wide variety of sanctions on Russia for its invasion of Ukraine. The country has frozen bank accounts of some of the wealthiest Russians and barred Russian planes from its airspace. At the same time, it has joined in the overall putting assets of the Russian central bank in sanctions.

As a result, many UK and US banks like Morgan Stanley and Goldman Sachs have declined sharply in the past few weeks. The main concern is that Russia could deploy its expertise in cybercrime to hack western financial institutions. In this regard, hacking the biggest banks in Europe and the US would be a good goal since most Russian banks are currently on life support.

Therefore, the Lloyds share price has dropped because of its role in the UK economy, with a leading share in mortgages and retail banking. The stock also declined because of fears that the Bank of England (BOE) would slow its rate hike cycle to prevent a recession.

Still, there is a likelihood that the BOE will maintain its rate hikes policy in a bid to prevent uncontrolled inflation in the UK. So, what next for Lloyds?

Lloyds share price forecast

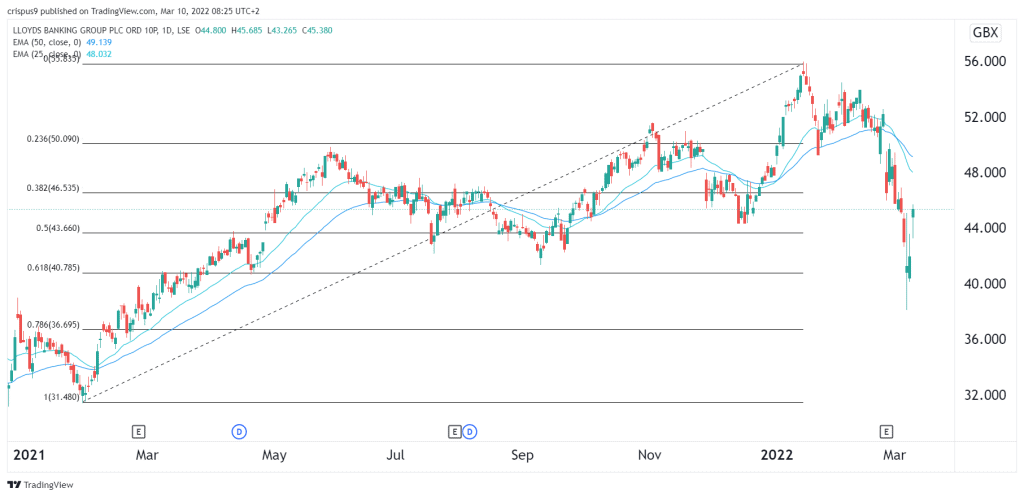

The daily chart shows that the LLOY share price crashed to a low of 38p this week. This was the lowest level it has been since March 2021. It was also about 32% below its year-to-date high.

The stock bounced back on Tuesday as UK shares rebounded and is now trading at 45.38p. This price is also slightly below the 38.2% Fibonacci retracement level. It remains below the 25-day and 50-day exponential moving averages (EMA).

Therefore, there is a likelihood that this rebound is part of a dead cat bounce, which happens after a major drop. While the shares are still attractive, there is a likelihood that they will resume the bearish trend in the near term. In other words, the bearish trend will continue as long as the stock is below the 50-day EMA.