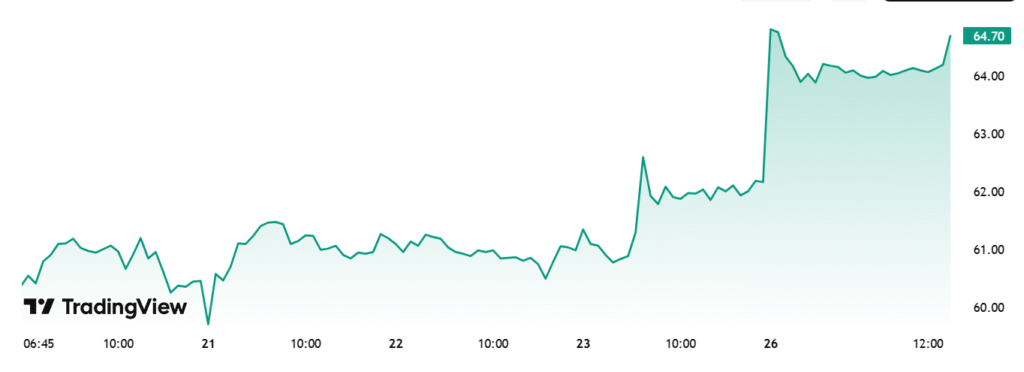

Suzlon Energy (NSE: SUZLON) Share Price Hits 5-Month High as Bulls Eye Q4 Trigger

Suzlon Energy share price was trading at ₹65.71 as of 1:50 PM IST on Monday, holding near session highs and marking a fresh five-month peak. The stock has climbed more than 20% in May, and with Q4 FY25 results just days away, bulls are now eyeing a clean move toward the ₹70 mark. A level that last acted as resistance in January.

Monday’s move reflects growing confidence in Suzlon’s fundamentals, particularly after a string of large wind project wins and rising investor participation. While no new announcements were made, momentum picked up sharply after the stock crossed above ₹62, triggering fresh buying from retail and technical traders alike.

The company’s wind energy pipeline stands at 5,622 MW, including a recently announced 378 MW order from NTPC Green Energy. That, combined with supportive policy signals on renewable infrastructure, has given Suzlon fresh legs just as the broader power sector regains favour with domestic institutions.

Retail ownership in the company rose to 55% in the March quarter, up from 54.6% previously. This kind of base-building typically suggests traders are anticipating an earnings beat or a strong update on execution and revenue visibility. The upcoming results will be the first since Suzlon reorganised project timelines across three southern states.

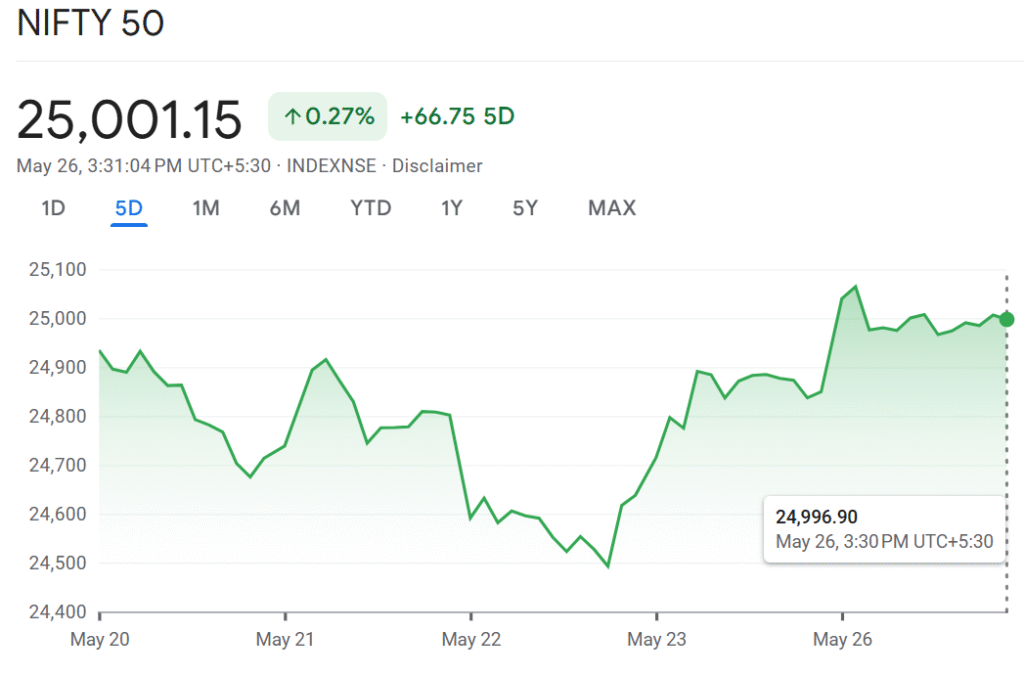

Sensex (INDEXBOM: SENSEX) and Nifty (INDEXNSE: NIFTY_50) Trade Higher as Momentum Builds Above Key Levels

It’s been a strong session for Indian equities on Monday, with the Sensex and Nifty 50 both holding firm in the green by mid-afternoon. The Nifty hovered just above 25,000, while the Sensex was trading near 82,300, putting both indices within striking distance of their next major hurdles.

The tone in the market feels different today. After a choppy few sessions last week, buyers have stepped back in with conviction. Sectors like auto, IT, and select large-cap financials are doing the heavy lifting. What’s helping? Global tailwinds for one. Traders are still digesting the U.S. pause on tariff hikes and cooling inflation data back home, both of which support risk-on sentiment.

It’s not a blowout rally, but it’s methodical. And that tends to hold better.

The momentum is back, but it’s not manic. If Nifty clears 25,344 and Sensex breaks 83,683 with volume behind the move, we could see a push higher into June. Until then, bulls are likely to defend dips as long as key supports hold.

Bajaj Finance (NSE: BAJFINANCE) Share Price Eyes ₹9,300 After Bullish Rebound

Bajaj Finance share price was trading near ₹9,270 on Monday afternoon, not far from its 2025 high, as bulls attempt to reclaim control after weeks of sideways action. The stock has gained nearly 6% this month, with short-term momentum building steadily since holding support above ₹8,700.

The latest bounce appears technically backed. RSI has recovered to 57.6, suggesting there’s still breathing room before overbought pressure sets in. Meanwhile, MACD remains in bullish crossover territory, with no signs of divergence. While the broader Nifty is getting most of the attention today, Bajaj Finance is quietly tightening its grip on the ₹9,300 zone, a level that’s been tested but never fully cleared. A strong close above that line could open the door to ₹9,480 or higher.

So far, there’s no major news catalyst driving the move; it’s more of a slow grind, underpinned by market strength and expectations of resilient Q1 demand in the consumer credit segment. If volumes stay steady and ₹9,300 gives way, the next leg could begin sooner than many expect.