Sensex crashes 800 points, Nifty nears 24,500, why is the Indian stock market falling?

Monday’s market session didn’t just open red, it opened confused. By mid-morning, panic had already gripped investors. What started as a jittery opening turned into a broad-based decline across sectors, led by global trade fears and a wave of caution in large-cap names.

The day was far from smooth. Indexes swung violently, and only a handful of stocks managed to stay in the green.

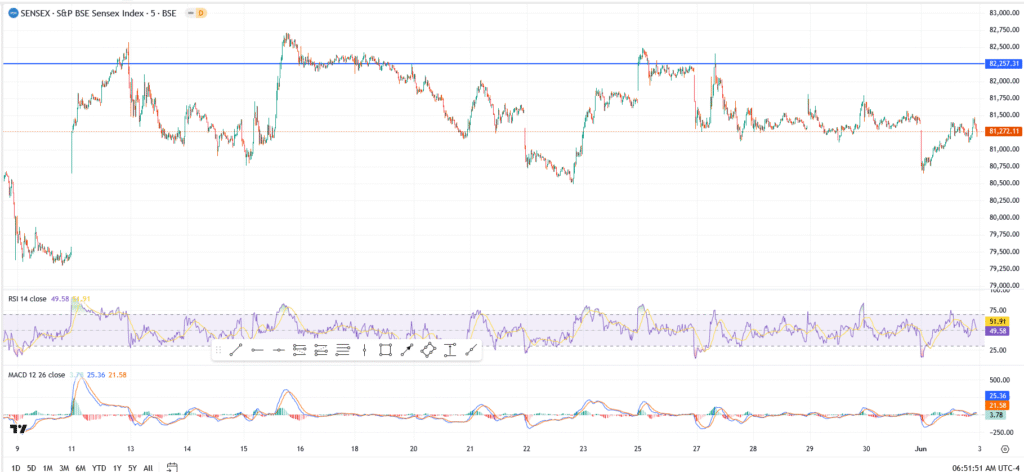

Sensex Tanks, Then Steadies, But the Damage Was Done

The BSE Sensex plunged over 800 points at its lowest, reacting sharply to headlines around new trade tariff proposals overseas. Although a late-session bounce helped it recover some ground, the benchmark still settled around 81,272.11, bruised and visibly tired.

Heavyweights were under pressure throughout the day. HDFC Bank, ICICI Bank, and Reliance Industries all slipped, dragging sentiment with them. The selling wasn’t just about valuations; it reflected a broader uncertainty brewing outside India.

For now, 81,500 looks like a ceiling that bulls are struggling to break. Every rally is getting sold into.

Nifty 50 Dips Near 24,500, A Level That’s Getting Tested More Often

Over at the NSE, the Nifty 50 dipped to 24,716.60, after briefly touching levels below 24,550. That zone has become a frequent battleground for bulls and bears. With the RSI barely holding at 51 and the MACD offering little direction, the index looks like it’s waiting on a catalyst, or perhaps more bad news.

Sectors were uneven. IT stocks fell after weakness in global peers, and metals weren’t far behind. Mphasis and Hindalco both clocked losses, and the broader undertone remained defensive.

If the Nifty can’t hold 24,550 over the next few sessions, traders may start preparing for a move down to 24,300.

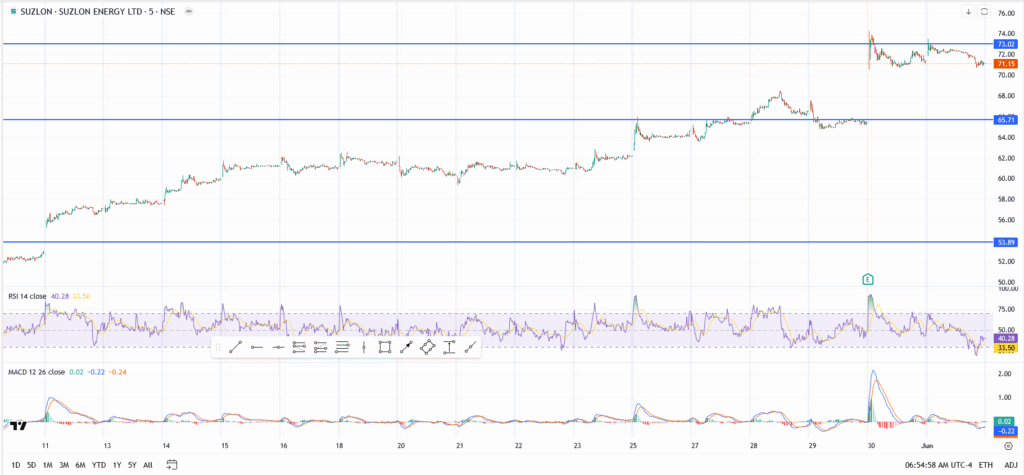

Suzlon Energy Defies the Mood, Keeps Climbing

One of the few bright spots in the session was Suzlon Energy, which continued its uptrend despite the broader selloff. The stock rallied over 10% in three sessions, now trading near ₹71.15.

What’s driving the rally? Mostly earnings. Suzlon’s Q4 results came in hot, and profit after tax surged by over 365% compared to the same period last year. That kind of surprise doesn’t go unnoticed, especially in a sideways market.

Technically, the stock cleared ₹65.70, and it hasn’t looked back. With decent volume, the next resistance stands around ₹73.00, followed by ₹76.50 if bulls stay active. RSI is in the low 40s, giving it space to move. MACD is flat, but momentum is still leaning positive.

Tata Motors Drops as May Numbers Disappoint

Not everyone had a good Monday. Tata Motors slipped after releasing its May sales data, and the market didn’t take it well. Total sales were down 8.6% year-on-year. Domestic performance fell 10%, and even commercial vehicle sales dropped 5%.

Investors had expected stronger traction coming into mid-year. What they got was the company’s weakest performance so far in 2025.

The stock ended the session near ₹710, and if it breaks below ₹705, the chart starts to look shaky. RSI is down to 42, and the MACD is curling south. The next support sits closer to ₹690, and traders are watching that level closely.

Outlook: Risk-On Pause, But Select Names Still Have Momentum

This wasn’t just a bad day. It was a reality check. Global tensions are back in focus, and Indian markets aren’t immune. Between external shocks and local underperformance in key sectors, the broader trend is looking heavy.

That said, it’s not all red. Names like Suzlon are proving that strong fundamentals still matter. If anything, the current climate is rewarding earnings strength and punishing misses.

Unless Nifty decisively reclaims 24,800, traders may stay on the sidelines. And if Sensex can’t hold above 81,200, the path of least resistance might be lower, at least in the short term.